Welcome to part 3 of my series on NYC office REITs. In this piece I am going to do a deep dive into Vornado (ticker VNO), and give my estimate of what VNO is worth (spoiler - it’s well above current share price of ~$16!). I’ll again refer you to my disclaimer page here - nothing here is investing advice.

Vornado, for those who do not know, is a Manhattan focused office REIT. Mostly. They also own a good amount of Manhattan retail, and a few properties elsewhere in the US (notably SF and Chicago). Historically VNO has been one of the larger REITs and is typically regarded as being well managed. Its founder, Steve Roth, is still the CEO and is one of the more well known people in the CRE world. VNO’s history is pretty interesting - the really short version is Roth acquired a retailer trading below the value of its real estate and parlayed that into the kernel of what became Vornado today. VNO has always been creative and opportunistic - usually it has worked out (220 CPS is a great example of this), but occasionally it has not (their Toys R Us investment).

Recently, VNO has struggled mightily along with pretty much all of the other office REITs. The stock is down nearly 80% over the last 5 years, and now looks very interesting. VNO is trading at a ~9% cap rate1, and low $300s psf to its Manhattan portfolio - an absolutely massive discount to pre-covid NYC real estate values which typically were sub 5% cap rates.

Before diving into the company value, a bit of good news was just announced this morning in the NYC office world. SLG sold a 49.9% interest in their 245 Park Ave asset at a valuation of $2 billion, or just over $1,100 psf. This is a great comp, and is one of the only large high quality Manhattan asset to trade hands recently (the other was 350 Park but one could argue that was land value). The $2b price is a slight premium to my NAV estimate (I also have a full SLG valuation and was debating which company to do for this article) and looks to be a low 5s in place cap rate. Given the low 80s occupancy my back of the envelope estimate is they are looking to stabilize in the lows 6s from a yield on cost perspective.

While this article is about VNO, this sale is a huge vote of confidence for prime Manhattan office space. And lo and behold, SLG is up ~15% as of mid morning 6-26, and VNO is up ~11%. It also gives me further confidence that my VNO underwriting is basically on the nose.

VNO shareholders in 3-5 years if I’m correct

VNO Value Summary

Here is where VNO’s value stands today at the current stock price of ~$16.00.

And here is my estimate of VNO’s Net Asset Value (or NAV), which is what I believe their portfolio to be worth per share.

That’s right, my NAV is over 3x VNO’s current share price!

Now – NAV is a levered measure of value, as it includes debt. As debt can drive huge swings at high leverage levels, I also always like to look at things on a purely unlevered basis as well. From this perspective, as you can see at the corporate level VNO’s debt is very low. At the property level it is also very manageable - its NYC office ex Penn is sub 50% (way below 50% if you include the mega Penn assets), and NYC retail is ~67% but VNO owns half of that debt in the form of a preferred equity stake. So the retail debt is overall quite reasonable as well. More detail on this later in the article.

What I find really compelling here is that my current gross valuation of VNO already contemplates a 36.5% unlevered value markdown for most of VNO’s office assets (eg my value is 63.5% of prior peak). When you layer that onto the current stock price, at today’s prices you are effectively acquiring VNO’s office assets at 39% of their pre-covid values. This isn’t Detroit – this is 40 cents on the (pre 30% inflation!) dollar for some of the most prime real estate in the entire world. It’s pretty much an unprecedented decline outside of the depths of the financial crisis.

Before we dive into VNO’s portfolio, it would be good to discuss a bit of history.

VNO has historically had three major issues that dogged it, which led to VNO trading at a significant discount to NAV pre-covid. The first is its large development pipeline - Wall Street analysts (shortsightedly IMO) hate development, as it adds to debt without producing cash flow for years.

The second is VNO’s long term viewpoint. A huge portion of VNO’s value is tied up in the Penn District, which is the area around Penn Station. This area has been run down for decades, but has a lot of potential due to Penn Station’s status as a major transit hub. VNO bought its Penn assets in the late 1990s as plans to redevelop Penn Station took shape and VNO has been talking about the area’s potential ever since. And for the first 20 years, pretty much nothing happened, or so it seemed. But the gears were slowly turning, and finally 25 years later the centerpiece of the redevelopment, the new Moynihan Train Hall, finally opened this year.

The third is VNO’s large NYC retail portfolio. NYC retail went through an epic bust from 2016 to 2021, with prime corridor rents down a whopping 57%. So in 2018/2019, while the knife was falling, the market reasonably discounted VNO’s retail assets significantly.

Luckily for (current) shareholders - all three of these major issues are in the process of being resolved soon. VNO’s developments will be done in the next 12 months and finally start contributing cash flow. The Penn District revitalization, 25 years later, will finally be mostly complete. NYC retail has decidedly turned the corner and is finally on solid footing - rents have bottomed (or are getting close), and vacancy is way down.

If it wasn’t for covid & WFH, Vornado’s future would be looking incredibly bright right now. I believe this disruption has created opportunity for investors, as I shall lay out below.

VNO Portfolio summary

So what does VNO own? Here’s a quick chart from VNO’s most recent supplement.

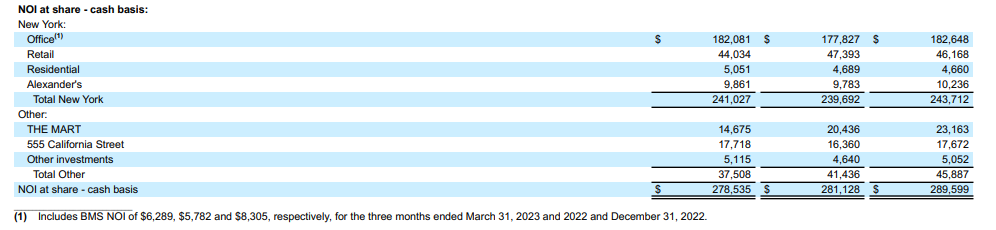

Further, here is the cash net operating income (NOI) from each segment, again per VNO’s latest docs.

Annualized the total NOI is just over $1.1 billion.2

As you can see, the lion’s share of the portfolio is NYC office. This portfolio is 89.9% occupied, down from peak occupancy of 96.70% before Covid, and is concentrated around Penn Station, and Midtown north of Grand Central Station.

The New York portfolio can be further broken down into operating assets, and development assets. The development pipeline consists of roughly $2 billion of spending today, and consist primarily of the Farley Building (leased to Facebook for 15 years, which just began to hit NOI at the end of 22, with another slug to come this year), and One Penn & Two Penn. I’ll dive more into these later. VNO has/had a very large development pipeline relative to almost any other REIT & has a long history of successful development deals. VNO built what is arguably NYC’s most successful residential development of all time, 220 Central Park South (220 CPS), which made so much money it kicked off a building boom & inspired a host of other developers to build ultra high end condo towers (none of which did as well) in the latter half of the 2010s.

The next biggest component is a NYC high street retail portfolio, with a heavy concentration in the high end Fifth Ave, Times Square, & Madison Ave submarkets. This portfolio has really struggled due to the aforementioned NYC high street retail epic boom/bust cycle over the last decade. However NYC retail has finally turned the corner, rents are starting to tick back up, and the market is in the best spot it has been in years.

VNO also owns a few high profile buildings outside of NYC. The most prominent is 555 California, a 1.8m sf high end office tower in downtown SF. This asset has managed to stay well leased, but is clearly at risk given the vacancy rates in that market. They also own 315 Montgomery, a 235k sf B building also in downtown SF, and the Merchandise Mart, a massive 3.9mm sf building in downtown Chicago that is a bit of a unique animal. Again more on these later.

Finally – VNO has a few miscellaneous properties, and then also a large 32.4% stake in publicly traded Alexanders. Since Alexanders is public it’s easy to take the face value of the stake – however this company is likely itself undervalued as well (trading at a ~8% cap rate). Alexander’s main asset is 731 Lexington Ave, which is fully leased to Bloomberg for their HQ through 2029 on the office side, and primarily leased to Home Depot on the retail.

I’ll cover each of VNO’s major holdings in detail. While I tried to portray what one might view as the bull case for office values (or more of a base case really) in my first article, for my NAV I have taken a conservative approach and am using higher cap rates & higher market vacancy. I think in an upside scenario (say interest rates fall significantly, or WFH reverts entirely) these numbers could surprise strongly to the positive, and in a downside don’t go too much lower.

Even though I think the facts are broadly supportive of my thesis here, I also realize the probabilistic cloud of outcomes & uncertainty is fairly wide due to this new variable of WFH. As such I believe some additional level of underwriting conservatism continues to be warranted until the final WFH picture resolves which I think will take likely another few years.

So – if you are someone who is focused on short term trading or results, this thesis is probably not for you (although in fairness almost none of my investments are short term oriented absent some kind of event based thesis). You need to be able to stomach continued weak results for what may be some time.

That said – I think for a patient investor VNO offers a very attractive risk reward, with a potential 3x+ return based on my NAV estimates (and that’s not counting the fat cash flow yield). Even if I’m dead wrong on WFH VNO likely still has good upside from today’s prices.

Operating NYC Office Summary

The largest component of Vornado’s value is its Manhattan office portfolio, which is concentrated primarily in a few submarkets: Penn Station, Park Ave, & Midtown.

The map is a little hard to read I realize… Buildings are colored by SF. Green is largest, yellow 2nd, red is third, blue is fourth. Green and yellow are what matter most from a value perspective.

I wanted to do a map with each asset’s dot scaled to my value for it, but don’t know how to create a weighted map like that / am too lazy to look it up, so you’ll have to live with this work of art instead.

I value each asset individually, however VNO has too many office assets to go through them all here individually, so instead I’ll give some high level commentary.

Notes: This analysis excludes The Farley building, Penn 1 & Penn 2, which I value separately later. This is why the VNO NOI is lower here than the $728mm number from VNO’s financials. Also VNO owns many assets in partial joint ventures, hence its share being lower than total NOI.

As you can see - the NYC office portfolio has relatively low leverage levels even on the reduced values I am using for this analysis. Also it’s worth noting that the distribution of portfolio debt and NOI is not even, and that if you weight the cap rate by the equity value of the various buildings, my average cap rate is in fact even higher at 6.64%. Again this compares to cap rates typically in the 4s before Covid.

Overall portfolio occupancy is 91.8% - down from 96.9% in Q4 of 2019. Occupancy declines have essentially flattened out, mirroring the overall market. I would expect though occupancy to fall a bit further in 2023 before bottoming out.

NY Office NOI at first glance appears to be flatish from 2019, being $718mm in 2019 and $728mm today, but this is misleading due to the addition of the Farley building, which has ~80% of its rents now hitting the bottom line which I estimate to be around ~$55mm.3 So really the more apples to apples number would be ~$673mm in same store NOI today, or about a 6.25% decline.4

However even this is a bit misleading, and by another measure one could argue SS NY office NOI really is flat today vs 2019. That is because most of Penn 2 was taken offline for redevelopment, resulting in a loss of ~$49mm in NOI by my estimates, almost entirely offsetting the Farley gain. Adding that income back in and same store NOI really would be flat vs 2019 - an incredible feat given what the office market has been through!

This flatish NOI against declining occupancy was achieved mostly via solid rental rate increases of ~5% from 2019 to today across VNO’s portfolio. And those rate increases come against overall market rent declines from 2019 to today (except at the top top end of the market like One Vanderbilt) of ~6%.

This just goes to show VNO’s prowess as an investor and an operator, and also the significant mark to market opportunity embedded in VNO’s portfolio in 2019. Given the trajectory of the Penn District and the face rents VNO says they are signing today at Penn 1 (breaching $100 psf), this portfolio rental increase isn’t over yet.

It also demonstrates that submarkets and assets still matter even in a down market, & the importance of asset by asset underwriting. The relative improvement in a given submarket or building can offset a large overall market downturn as we can see from VNO’s portfolio.

Finally as a reminder - at VNO’s ~9% cap rate today, if 6% is a ‘fair’ cap rate, we’d need to see a 33% decline in NOI to get there!5 Given overall market trends I don’t see any evidence it’s going to get anywhere close to that bad.

I’ll go into the Penn District more later, but I do want to hit upon a few notable assets in VNO’s NYC office portfolio (outside of Penn).

350 Park Ave

The first is 350 Park Ave, which is an A building on Park Ave.6 In a huge vote of confidence in the office market, Citadel agreed earlier this year to form a joint venture with VNO to develop this asset into a brand new headquarters tower.

More specifically - Citadel is master leasing the current asset as is for 10 years. They are also agreeing to either A) buy a 60% share in a development JV7 valuing the site at $1.2 billion (VNO is combining their building with a site the Rudin family owns next door, so VNO’s share would be $900mm in this deal), or B) acquire the site outright from VNO/Rudin for $1.4 billion ($1.085 billion to VNO at share).

The start date for these options is October of 2024 and the option period runs through 2030. VNO also has the option to put the property to Ken Griffin (Citadels owner) for $1.2 billion. It looks like the last of the building’s current leases run through August of 2024, hence the delayed start date.

This deal is just a home run by any measure, and is such a strong affirmation of class A NYC office. But the market seems to be completely ignoring this sale - it is effectively a forward sale of the site for $900mm to VNO, minimum. My asset value for 350 Park before the deal was announced was $725 million, so this is a purchase for 24% over my fair value!

And my fair value for VNO’s portfolio is massively higher than today’s stock price as you saw above. Given the $400mm in asset level debt, this deal is ~$500mm in value to VNO, or ~$2.40 /share just by itself. Now - the value here is driven more by the property’s value as a development site, but the fact that it’s an office development site just reaffirms the value of top flight office buildings. The new development would be 1.7 million square feet, so at $1.2 billion the land basis is $705 per buildable square foot. That’s 2x in land value what the market is currently ascribing to VNO’s existing cash producing buildings! Just a wild level of divergence between a major office user (not to mention a pretty savvy investor) & your average REIT investor. I’ll take Ken Griffin here thanks.

1290 Avenue of the Americas

1290 Ave of the Americas is a huge 2mm sf tower built in 1963 with 12 ft ceilings. It is located in the heart of midtown right by Rockefeller Center & is also one of the assets Trump owns 30% of. This asset is notable not only because of its sheer size, but also because it has VNO’s largest upcoming known vacate, where Equitable Life insurance is giving back 335k sf at the end of the year as they move to a new HQ building. Equitable’s rent is $35.3mm. I am assuming this space is not released before the end of the year, and in fact just underwrite this building as if this space remains vacant to be conservative. So I expect VNO’s NYC office NOI to drop by ~$35mm by the end of 2023 (partially offset by the rest of Farley’s free rent burning off).

The building has an $950mm loan on it (which I allocate 90% or $855mm to the office component), and I am giving the asset a total gross value of $1.36 billion (again to the office space, retail is separate), or just under $670 psf, based on a 6.25% cap rate. So VNO’s equity share is about ~$357mm here.

In sum: VNO’s NYC office portfolio has performed surprisingly well from a cash flow perspective from 2019 to today. While occupancy has fallen along with the broader market, rental rate increases driven in large part by the improving Penn District allowed VNO to offset much of this decline. However we are not out of the woods yet and with Equitable Life vacating 1290 Avenue of the Americas at the end of this year, we will likely see another decent leg down in NOI unless VNO can back lease that space in the next 6 months.

The actual performance of cash flow (slight decline) stands in stark contrast to VNO’s share price performance over the same time period (massive decline). We are over 3 years into Covid - one day I believe in the not too distant future the market is going to wake up and realize the precipitous decline in cash flows people have been worried about for 3 years just isn’t happening.

Development Assets & NAV discounts

As I mentioned in the intro, Vornado is a very active developer, which is relatively unusual for a REIT. Wall Street analysts and investors consistently do not give REITs credit for in process developments, leading to firms with large development pipelines trading at NAV discounts. But not only did VNO have a large development pipeline - a large share of VNOs value is also tied up in the Penn District, or the area around Penn Station. An area with a lot of potential but historically limited cash flow generation. To make matters worse - Steve Roth and VNO have been talking about the potential of the Penn district literally since the 2000s, so not only was cash flow generation limited, but over a decade went by with little happening.

So it’s no surprise that pre-covid VNO traded at a large NAV discount - the firm’s NAV was ~$90-95/share according to some analysts, and yet the stock traded in the 60s! As an aside I do think some of this was well placed skepticism about VNO’s retail portfolio, in addition to the development issues.

So one could argue that some portion of VNO’s NAV discount today is inevitable due to their current large development portfolio.

But luckily for us, the Penn District is actually finally coming to fruition. It isn’t ‘in process’ with some indeterminate completion date. The new Moynihan train hall, the centerpiece of the Penn Station redevelopment, finally opened this year, nearly 30 years after it was first proposed in 1993 by its namesake senator.

VNO & the city have already spent billions around Penn, with more to come. VNO has 3 major development assets in the area - of these, one is done, and the other two are under construction with completion dates in the next 12 months. I’ll dive into these assets in detail, but first I’ll spend some more time on the Penn District in general.

The Penn District

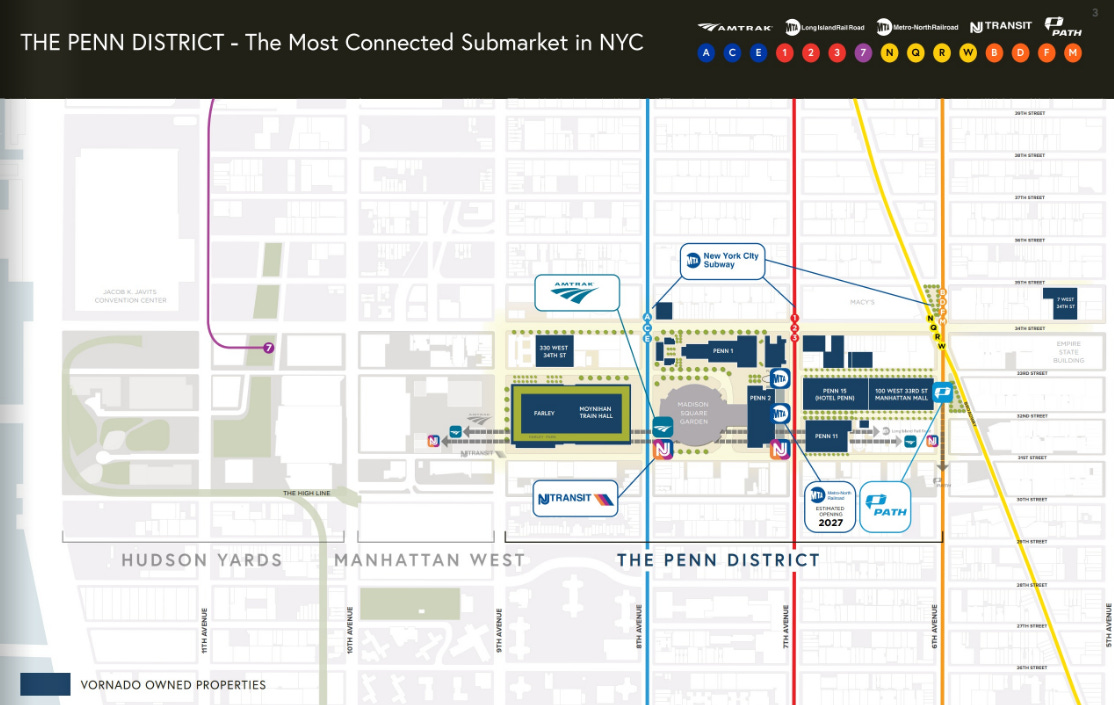

Given VNO’s concentration around Penn Station it’s worth diving into the neighborhood in some depth. A map may be helpful in our discussion - see below courtesy of VNO.

For those who don’t live in NYC - Penn Station is one of the city’s two major rail hubs (the other being Grand Central). It served 650k riders per day before covid, making it one of the busiest transit hubs in the country. Penn is a hub for the Long Island Railroad, NJ Transit, & Amtrak. LIRR and NJ Transit are the local commuter rail lines serving Long Island and New Jersey. Amtrak’s Acela line, which is actually good, stops in Penn Station and is a great way to travel anywhere between DC and Boston. And unlike Grand Central, Penn is also a huge subway line hub, with just about every single line in the city excepting the 456 running either through it or very close. In other words, Penn Station has the best transit access of any location in NYC by a good margin. And it’s going to get better - Metro North, the third commuter line serving the northern suburbs and CT, is extending to Penn Station and will open up hopefully in 2027.

The next thing to know about the area is that Penn Station has historically been a bit of a rough place - just grimy and gritty. This is primarily for two reasons I think - the first is a fairly significant homeless population. One issue is that unlike Grand Central, Penn Station is open 24/7 (the new Moynihan train hall closes overnight which mitigates this somewhat). The second is the area is just plain unattractive. Its major feature is Madison Square Garden, which if you have never been, is a serviceable arena but a damn ugly building.

This is from MSG’s official site… yes that is the actual best picture even the owners could find.

The buildings around MSG are also not in great shape. The whole area has just felt a bit run down in general.

Now the area wasn’t always this way - when Penn Station was built in 1910 it was a beautiful building. Here is a picture of the old terminal. Sadly the building was demolished in 1963 as the Pennsylvania railroad auctioned off the site. Rail travel had been in decline and it was expensive to maintain a massive facility in the heart of Manhattan.

“One entered the city like a god; one scuttles in now like a rat.” - Art historian Vincent Scully on the old Penn Station

But - what is old may become new again, as recently Penn Station has been improving thanks to a massive multi billion dollar investment in the area from both public and private sources, with more investment likely in the pipeline.

The first and most important component of this redevelopment is the new $1.6 billion Moynihan Train Hall (named after NY senator Patrick Moynihan who first proposed the project in 1993!), which just opened earlier this year after 3 years of construction work and over 25 years of planning. Infrastructure, especially in New York, is slow. But while it happens slowly, the wheels do turn. Moynihan a great new train station which provides access to all the rail tracks below, and it has turned a dungeon into a beautiful light filled space. This train hall is the catalyst for the revitalization of the whole area - Vornado has been waiting for this day ever since they acquired their Penn assets back in 1998 - 25 years ago!

Next - as I mentioned above, Metro North is extending into Penn Station by 2027, which means soon Penn will provide direct access to all of New York suburbs, whereas Grand Central only offers 2 out of 3 (missing New Jersey).

Third - Vornado is itself contributing significantly to the area renovation as well. VNO is partnered with the City & State on the redevelopment of the area - VNO led the Moynihan redevelopment, and is currently renovating the LIRR concourse under MSG. On top of the building renovations VNO is conducting, both public and private, VNO is spending $100 million on districtwide improvements (of which it has spent $42mm thus far). The most notable improvement is a large new street entrance to Penn Station on 7th ave, but there are also a number of improvements to the sidewalks, new greenspace, etc. VNO also controls several development sites in the area, so there is likely further redevelopment and improvement to come. But that is all far off and is all upside in my underwriting.

Finally - while nothing is concrete yet the State and City have been working on plans to renovate the balance of Penn Station & further improve the area. The last iteration, proposed a year ago, called for tons of new office development (to be led by Vornado) to finance improvements to the balance of Penn Station and was recently mothballed because the market for new office towers isn’t so hot these days. A new plan has not been settled on8 - so from an underwriting perspective I don’t think it’s worth putting much stock here, but it’s additional potential upside if it does happen. Both in terms of location appeal and potential fees / profits for VNO from future development.

I could go on but hopefully you get the picture. A full brochure on the area is here, courtesy of Vornado. The main takeaway here is that Penn Station is already significantly nicer than it has been, and has more improvements to come. The City is also fully bought in - they are working hard to reduce crime and vagrancy in the area. The current batch of renovations should wrap up in the next 12 months, and Penn Station is going to feel like a whole new place once they are done. Now I don’t think Penn District is ever going to be getting prime Park Ave rents, but I do think it could become pretty competitive with current office darling Hudson Yards. After all, Hudson has the same transit access as Penn, but just worse, being nearly half a mile further west. So in 5 years Hudson Yards could easily be playing second fiddle to the Penn District.9 But this scenario is all just gravy to my underwriting, which assumes Penn continues to command rents at a significant discount to Hudson Yards.10

The Farley Building

The Farley Building is the first Penn District asset to be completed, and is a trophy asset for VNO by any metric. It’s a renovation of an old post office building, and is fully leased to Meta with a lease term of 15 years. Vornado spent $1.12 billion on this project, with a target yield on cost of 6.2%, for an NOI of ~$69.4 million.11

Meta’s lease began in summer of 2021, however they secured 18 months of free rent for 80% of the space, and an additional 6 months for the remaining 20%, so the NOI only began to hit in Q4 of 2022 and Q1 of 23.

Farley is owned free and clear of debt, however it is on a ground lease with the city of New York. The ground lease should not have a large impact on valuation though – it runs through 2116 for a fixed, annual payment of $4.75mm with no contractual rent increases. Given the long term and fixed payments the ground lease should have little to any impact on cap rate.

Now – what cap rate to use on this asset & others is an open question given the state of the market today. Certainly before covid this would have been a low 4 cap asset. This is top quality real estate - one of the best assets in the market, directly on top of a major transit hub, leased to a credit tenant for 15 years. My base estimate is that once the market normalizes it will be a ~5.25% cap rate (or a ~20% decline in value from pre-covid). The value today is harder to say – I’d guess it could be as low as development cost on the open market. Even at the $1.12 billion of cost that is $5.40 / share in value – just to the Farley building by itself! At a 5.25% cap it would be $7.88 / share in value – that is over (50%) of VNO’s current market cap! For purposes of our analysis I will use 5.50% as a base case value today, or $1.26 billion, just over $6/share.

But we aren’t done yet – the other two mega projects are similarly hugely valuable. I hope you can begin to appreciate the scale of the margin for error this investment has…

Penn 2

Penn 2 is the second of VNO’s mega projects. This is a complete redevelopment of an older building into a brand new tower. The overall project will contain ~1.8 million square feet upon completion, and Vornado is investing $750 million into the redevelopment. Construction work should finish at the end of 2023.

Vornado does not break out how leased the project is unfortunately, but indicates in their quarterly calls that leasing is strong. 12

My estimated value for the project upon completion is below. Vornado shares target yields for their development projects, however since Penn 2 is a redevelopment we must also account for the base building’s potential NOI & value. The base building is mostly empty, so I assign it a low $300 psf flat value. Adding the two together & using a 5.75% cap rate gives us ~$1.7 billion in value, or just over $950 psf.

Figures in millions except for square feet

One could argue whether 5.75% is the right cap rate but the fact of the matter is that the replacement cost for this asset is likely $1,250 psf, if not higher. It’s a brand new building directly on top of Penn Station. And with $1,250 replacement, no one is going to build unless a building were worth ~$1,650 psf minimum. So my value is effectively ~57% of a normalized market value and is ~75% of replacement just by itself.13 As another sanity check - this kind of asset would have traded in the mid to low 4s before covid, so 5.75% is a 22%+ reduction.

Finally - given the base building value is so low, my implied cap rate is actually likely significantly higher than 5.75%. This is because at a 5.75% cap the implied NOI for the base building is ~$27mm, and so the implied combined Penn 2 NOI would be about $98 million or about $55 psf.

Given rental rates above $100 psf14, and say 10% vacancy, NOI should be more in the $60-65 psf range. At $60 psf in NOI, my $950 psf value would be a ~6.23% cap rate, which would be more like a 28% or more discount to pre-covid cap rates.

One final item here - VNO is currently midway through the development. They have spent ~$450mm on the project, and have another ~$300mm of spending to come (to come out of cash on hand). So the net value here to VNO at $1.7 billion is actually ~$1.4 billion after accounting for the cash spend yet to come. That is just under $7 per share from this building alone. For those keeping track at home, that means Farley + Penn 2 are basically equal to VNO’s entire market cap, just by themselves. And both assets are completely unlevered.

Penn 1

Penn 1 is a 2.5 million square foot office tower directly adjacent to Penn Station, on the north side.

It’s a 1972 built tower that Vornado is wrapping up a large renovation of. Unlike Penn 1, this was not a full redevelopment & the spend is much lower at $450mm, despite a larger building.

I can’t find an exact full scope of renovation but it looks to have primarily consisted of a lobby renovation, exterior repainting, and a host of new tenant amenities. If you are curious, the property brochure is here. I think the building looks pretty good so far - renovation isn’t quite done yet but overall physically it’s a pretty good product now15.

The tower also includes 318k sf of retail, in which VNO lumps in their LIRR concourse retail. Unfortunately I can’t find a breakdown of how much of this is LIRR vs street level, but from my best estimates it looks like the LIRR is a relatively smaller portion of the total retail SF.

Leasing here is ‘on fire’ according to VNO, with office rents breaking $100 psf. The big problem with this property is it’s on a ground lease16, which has a fair market value reset this month! This reset could chew up some of the value VNO is creating. Vornado is arguing that value has gone down due to higher interest rates etc - which in fairness is true of the overall market. This reset makes it hard to underwrite, we could see a big swing in value one way or another depending on where it shakes out. The current ground rent for the office is $2.5mm / year - not crazy high given the property size. The resets happen every 25 years, and I haven’t been able to find what the prior fair market value was, but I think it’s conservative to assume this is going to go up. Given the lack of specific information on the ground lease I have elected to use a fairly high cap rate of 7.5% when valuing this asset to account for the uncertainty as to where the new payments will shake out.

So what is this building worth? My estimate is below. Again VNO doesn’t disclose building level NOI, but they do disclose their target yields on development spend. So I try to estimate the current NOI + incremental NOI from the development spend to get a total NOI. As the building is only under renovation it is still occupied - about 81% at $74 rents. For reference it was 90% leased at $69 rents before covid.17

Couple comments here. First - this value is a ‘stabilized’ value, which is to say after VNO is able to roll the rents at the existing tenant base to the new higher market rent, and the retail redevelopment is completed. So this will take a few years to achieve.

Second - this is assuming VNO is including TI & LCs in their development spend. Most operators would capitalize the spend on a big redevelopment so I assume VNO does as well. I also have trouble seeing how they spend $450mm without it including TI/LC, given the redevelopment scope as I know it.

Third - the cap rate is higher here to account for uncertainty around the ground lease. If this resolves favorably it could be a nice bump.

Finally - as a sanity check $705 psf feels pretty good here relative to replacement given the sizeable retail component, the ground lease terms, the location & the asset quality.

Penn 1 is again, unlevered at the asset level. With $65mm of spending yet to come, this gives us a little over $1.73 billion in value, or ~$8.25 / share!

Vornado’s 3 Penn Station redevelopments will add a total of $200mm in additional NOI to VNO’s bottom line, and are combined worth over $21 per share. VNO’s share price as of this writing is ~$16.00.

One more thing here on rental rates - One Vanderbilt, the brand new tower by Grand Central, has rates averaging $150 psf. So at $100 psf, the Penn District’s top assets have a lot of room to run if the gap closes. I doubt they ever get to $150 psf (at least this decade), but I don’t think it’s crazy VNO’s big 3 Penn district assets are able to eventually get rents on par with neighboring Hudson Yards, which are currently around $130-140 for the newest assets. An extra $20 psf across Penn 1 & 2’s combined 3.8mm sf of office space would be an extra $76mm in NOI. The market isn’t there today, but by 2028 I don’t think that’s crazy at all. So the Penn District has a ton of very reasonable upside I think above and beyond my underwriting.

Onto the other major part of VNO’s portfolio, retail.

NYC Retail Summary

VNO’s retail portfolio is quite large – at $176mm in NOI it could be a REIT by itself (albeit a smaller one). The portfolio was historically much larger - VNO has a long history of retail investing and ownership. In fact the REIT Urban Edge Properties is a spinoff of most of VNO’s old retail portfolio - so VNO has a long history of investing in retail.

Most of the current retail value is concentrated along the ultra high end corridors of Fifth Ave, Madison Ave, and Times Square, but there is also a good amount spread across Manhattan in the Penn district, Midtown, Soho, Union Square & Chelsea.

4 Union Square South, one of VNO’s retail assets.

The portfolio consists of both equity ownership, and a large $1.828 billion preferred equity stake held in certain assets which Vornado also owns an equity interest. The preferred equity is held in what is called the Times Square JV – this consists of 7 assets, which VNO sold a 48.5% effective ownership stake in 2019 to a group of investors. The LPs bought in at a $5.56 billion dollar value, which was a 4.5% cap rate, & at time of contribution the deal consisted of $2.778 billion in equity, $950mm in debt, and $1.828 billion in VNO preferred. So VNO’s total interest at contribution was the $1.828 billion in preferred + 51.5% of the $2.77 billion in equity, or another ~1.44 billion in value.

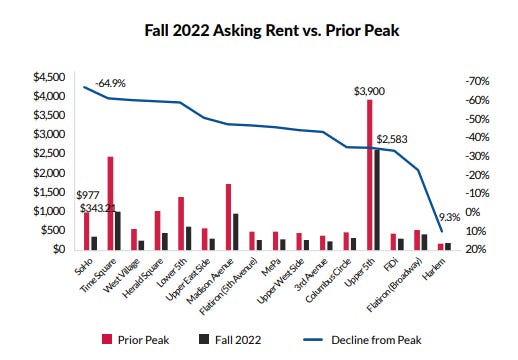

This deal was done at arguably peak values, despite being several years into street rental rate declines – pretty good market timing by VNO. As I mentioned before, NYC retail rents and values saw an epic run up from 2011 to 2015, and have since fallen rapidly since peaking in early 2016 (Time Square held out a bit longer).

Frankly I have yet to see a great accounting of why this happened, but as far as I can tell there was a bubble in ultra prime rents where high end retailers decided they would pay almost any sum of money to have a storefront in one of Manhattan’s top end retail districts, with the idea being that although the store lost money it was still profitable from a brand awareness perspective.

This combined with NYC’s very limited inventory at the time to create just astronomical increases in prices – you had tenants with little to no cost sensitivity bidding over only a handful of spaces.

However – the increase was unsustainable as we now know. Retailers ceased to accept massively unprofitable stores for nebulous brand equity, and additional supply was unlocked as developers converted additional space into retail (in NYC not only can a high street grow at either end, but developers can also add space above the street front stores, as 3-4 story retail spaces are fairly common in prime districts).

The result has been a huge decline in rents & increase in vacancy. Rents in some submarkets are down 60% from their peak per REBNY’s retail reports. Other prime areas like Madison Ave and Times Square were similarly hammered.

Many investors and developers (foolishly) bought in at peak values with the intent of redeveloping a space or massively raising rents at lease rollover. Once the market fell out, many owners elected to hold their space vacant for years in the hopes the market would recover, as accepting a lower rent would acknowledge their investments were wiped out. Over time these owners have been forced to accept reality, and lease space out at much lower market rents.

Now the NYC retail market is actually in a fairly health place. Demand is as good as it has been in many years. Living in NYC personally I can attest to this – the retail market is far better occupied and more vibrant today than it was when I first moved here in 2017. Most importantly market rents have stopped declining, and have even begun to tick up again in certain submarkets.

As such – VNO’s retail portfolio is actually in the best place it has been in years18. Now it may not seem that just way looking at NOI, which has declined by nearly half from 2018 when retail NOI was $324 million as it has taken awhile for some of the massively overmarket leases to roll over, but the new lower NOI incorporates much of the market damage which has already been done.

VNO has themselves written down the value of their Times Square JV (which contained some of the most overmarket rents) by $889 million, or about 31% on an unlevered basis. VNO is now carrying the JV (pref + equity) at $2.314 billion, & I am underwriting it ~10% lower still at $2.088 billion.

My overall value for VNO’s retail portfolio is a ~5.55% cap rate based on portfolio NOI of $176mm. Now I don’t actually just cap NOI and call it a day… I underwrite each asset individually. However Vornado owns 52 retail assets, so there is just no sense in going through them all here. Instead I’ll provide a bit of high level commentary here on overall assumptions and key issues.

Note: the total retail debt above is inclusive of VNO’s $1.8 billion preferred stake. Also the cap rate listed here is higher than the 5.55% I noted above because the 5.55% is weighted based on equity values. So some higher cap rate assets have little to no value over the debt (due to overly high rents), and thus are essentially discarded in the equity weighted analysis, meaning the effective underwritten cap rate is lower.

The first thing to understand about the retail portfolio is that there are still some embedded above-market rents that have yet to roll over. Several of these will hit this year and next, and I expect overall we will see several million in further NOI declines as these rents roll to market. In my underwriting I account for this on an asset by asset basis.

On the positive side, the overall portfolio occupancy is only 74%, so there is some upside to NOI growth by leasing up vacancy. This statistic is a bit misleading though, as half of the vacancy is at 100 West 33rd Street, the former Manhattan Mall. VNO’s management have mentioned on their earnings calls that they are working on a conversion of this space to movie studio / sound stage space. So VNO appears to be intentionally keeping this vacant, and it will probably be categorized as a development asset once that happens (I assign this property little value, probably harshly).

So really the vacancy is more like 87%. Most of this in turn sits at the Farley building, inside the new Moynihan train hall. This is prime space, being inside one of the largest transit hubs in the country with sky high foot traffic counts. VNO is averaging over $400 psf on the leases they have already signed here. This space will definitely lease. There is about 87k sf of vacancy here - at $400 psf that could be another $34mm+ to the bottom line. Even at $200 psf it’s ~$17mm, which would be a 10% increase in VNO’s retail NOI by itself.

So - I believe my retail underwriting to be pretty conservative. VNO’s retail NOI in two years will likely be over a 6% yield at my current valuation, putting it roughly in line with ‘A’ grade retail values elsewhere across the country. Of course historically NYC retail had traded at a significant cap rate premium to secondary market suburban retail - at a 5% cap rate VNO would pick up $680mm in additional value, and at a 4.5% cap rate (where we were pre-covid), it would be $1.1 billion in additional value (over $5/share in an upside scenario on top of the ~$15 /share in retail value in my base case scenario). Again not in my base underwriting, but it wouldn’t surprise me if that’s where we were in a few years as a reasonable upside case.

Other errata - I would be remiss to not mention VNO’s recent default on the $450 million loan at 697 Fifth Ave, part of the Time Square JV. I obviously assign this no value, and it is not surprising given the rents here vs market & the debt load. It’s also worth noting that by my underwriting the TS JV has very little equity value above VNO’s preferred position. If this were not the case one might argue that VNO’s pref is impaired somewhat due to the rise in interest rates, but given the lack of equity cushion above I think it probably converts at some point.

It’s probably worth dwelling on here for the uber office bears - a significant portion of VNO’s total value is tied up not in office, but retail. At VNO’s roughly ~$6b EV today (looking at just corporate level debt + preferred, not property level), $3b of that is covered by its retail holdings.

Other Assets

555 California

555 California consists of three office assets in San Francisco, which together make up a full city block. VNO lumps these together for reporting purposes & has a 70% interest in these buildings (Trump being the holder of the other 30%). The first, the eponymous 555 California, is a 1.5 million square foot class A tower built in 196919.

The other two buildings are 315 and 345 Montgomery street, two B assets consisting of 313k sf combined.

There is no need to spend much time on this - I’m conservatively valuing the equity in these buildings at zero. There is potentially a call option here on a SF recovery though. The assets do $70mm in NOI at share, against $876mm in debt at share (not a great debt yield). They are well leased and have actually increased NOI since before Covid. 555 California itself is a really nice building. The current large loan of $1.2 billion dates to 2021 & was done at very low interest rates, with a 2 year term and 5 one year options. VNO can extend so long as they keep buying interest rate caps.

The reason I’m giving these no value is that the SF office market is just a disaster right now, so it’s hard to underwrite as we don’t know where the bottom is. Combine that with the large loan, whose debt service coverage on a mark to market loan gets pretty tight, and it feels prudent to ascribe de minimis value to these assets.

In reality - I think there is a decent chance VNO is able to ride the storm out and hold onto these assets, SF eventually comes back and they probably do have some value 5 years hence. But given the market vacancy rate of nearly 30%, the political and quality of life issues, and Wells Fargo selling a vacant B building across the street for a mere $120 psf, I think zero value is a reasonable base case underwriting assumption. As an aside - this is why you can’t just look at total leverage levels for a REIT. Given most debt is property level what matters is the value of a given property against its given debt load.

The Mart

The Merchandise Mart (aka the Mart) is a massive ~3.9 million square foot office and showroom building in downtown Chicago. It’s a bit of a unique asset. First - the Mart is absolutely massive, and its floor plates are just gigantic. This causes problems for the leasability of interior space.

So if you were completely unfamiliar with this asset, it would probably look like complete crap. However, the Mart occupies a bit of a unique spot in the Chicago market in two ways. The first is that it is ground zero for Chicago’s tech ecosystem. The Mart is home to a famous (in Chicago at least) tech incubator called 1871, and has managed to become an ‘it’ address for Chicago tech companies. Usually I don’t buy this kind of thing as a building being ‘special’, but I have spent a lot of time in Chicago and can say with confidence it is true. So the building sees a disproportionate amount of leasing relative to what you’d expect given the quality (the interior has that cool industrial loft look - the only problem really is the floorplate size).

The other crucial piece of information about the Mart is that 1.46 million of its square footage is dedicated to trade shows & show rooms, primarily in the design space. This revenue was really hit hard during Covid, and has since rebounded.

The lingering effects of covid + the tech downturn has caused the Mart’s total NOI for 2022 to decline to $58mm from just over $100mm in 2019, and its occupancy to ~80% today vs 94.6% in 2019. The most notable tenant is Google for 572k square feet via its old Motorola Mobility subsidiary, with a lease expiration in 2028.

This is also a tricky asset to value, as it is difficult for me to underwrite the trade show value given my limited knowledge of that sector, and its unique position in the market causes the building to outperform what one might otherwise expect given the floorplate sizing. So again I am trying to be conservative with my valuation here, and am using a 7.5% cap rate on its current, significantly reduced NOI, which gives us a value of ~$778mm.20 The Mart is currently unlevered, as VNO paid off its maturing $675mm loan in 2021 in full.

Again - I think this asset likely has significant upside. For what it’s worth VNO’s management is predicting a return to pre-covid NOI - if it can get even close to 2019 performance you could see several hundred million in additional value here.

Miscellaneous

To quickly run through the rest of VNO’s portfolio.

They own some residential, but it’s primarily in two large complexes with significant leverage. I assume the rent control law changes impacted these assets very negatively, and give them no value.

VNO owns some random leftover assets in the DC area (VNO used to own a lot in DC, and spun this off into JBG Smith) & also owns some ground leases, one partial interest on 34th street and another for land under the Borgata in Atlantic city. Collectively I estimate these are worth ~$134mm (the ground leases being most of that) - a rounding error in the NAV.

The one other asset that is worth mentioning is the former Hotel Pennsylvania development site. It’s a huge site (half a block) right across from Penn Station. I don’t think anything gets built on this any time soon, but it’s a pretty good site and definitely has value. I give it a value of $200 psf to the buildable square footage, using 1.5mm square feet as buildable, for a value of $300 million. This could potentially actually be worth a good bit more, but I think $300mm is a fairly safe number to use. For context again 350 Park is effectively selling to Citadel for $705 psf to the buildable square footage, over 3x the basis here. Obviously 350 Park is a very different site, but in 5 years it’s not inconceivable the Hotel Penn site is viewed as ultra prime real estate and could command a huge price tag.

NYC Office Market Summary

I covered this in my prior two articles (links here, and here), but given how important it is I want to spend a little more time on the subject before wrapping this article up.

First I want to touch a bit on rents (I focused more on vacancy in my prior articles). Rents are down along with the increased vacancy, but it’s harder to say how far rents have fallen as landlords have tried to increase concession packages while holding the line on face rents. Concession data isn’t as readily available as face rent data or vacancy data, so vacancy is a cleaner over time comparison for market health in my opinion. Analysis of market rents is further confounded by the fact that the market has seen actual rent growth at the top of the market! But for your average B/A- tower, clearly rents are down - seemingly around ~6% according to multiple data sources. Market rental rates are not quite as relevant for VNO as so much of their value is in the Penn district, which is overall increasing its rental rates relative to Manhattan as a whole. OK moving on to the fundamentals.

NYC’s office market demand growth was quite healthy before covid. Metro NYC grew office using jobs about 1.75%/year from 2013 to 2020, or about 43k jobs / year.21 Office demand did not grow at the same clip due to shrinking square footage per employee (Wework is the most notable example of this trend), but it was still healthy enough to trigger a new supply wave pre covid (one that is only just now wrapping up!).

The trends underlying this growth were continued growth in NYC’s primary industry, financial services, and strong relative growth in tech and to a lesser degree, biotech/pharma. This can be seen in VC funding - by 2019 NYC captured 20% of all VC investment in the United States, with funding increasing 7x from 2010 to 2019.

I am leaving off the post covid VC madness as it skews the numbers, but NYC (like Silicon Valley and Boston), received record amounts of VC funding in 21 and 22, with 21 hitting over $50 billion. For context sunbelt darling DFW received $420 million in VC funding in 2019 per Crunchbase…. about 8% per capita of what NYC did.

Obviously all three of these industries are facing headwinds today, but it seems very reasonable to me to expect all three to eventually return to growth, and NYC to continue growing office jobs at about the same clip it did pre-covid.

So we can project a few things about the remainder of the decade with relative confidence. One: NYC will grow office jobs at a continued healthy clip. Two: The office market will benefit from likely at least ~2% of supply being removed from conversions (again see my article linked above on conversions). Three: No other new supply is going to get built until investor demand and valuations for office space recover.

So we will have increasing demand (in the form of office jobs) and shrinking supply starting likely in about 12 month (as demand is likely to continue to suffer for a bit and the final new supply begun pre-covid delivers).

The only real unknowns are how office job growth will translate into office demand, and how much more space will be lost from companies downsizing.

As I argued in my first article, again we are three years into covid. At this point the trend on WFH is almost universally towards more office use, not less. Firms that went all or mostly remote have already (mostly) put their office space on the sublease market, and it’s captured in vacancy statistics ( albeit not fully in owner incomes). I’m sure we’ll still see a bit more WFH related shrinkage over the next year or two as slow moving firms finally decide on their policies going forward, but the key thing to realize is that at this point, most of the damage is done.

So - we can try to take all of the above into account and make some rough predictions about the NYC office market in say 2030.

If you assume NYC metro adds another ~267.5k office using jobs from the end of this year to 2030, and NYC proper captures 80% of that22, at a fairly conservative 175 SF per employee that is 37.5 million sf of demand. New supply of 9.4 million leaves us with ~28mm left over to dig into vacancy. That would bring the market to sub 12% vacancy, very healthy.

But wait, that doesn’t include the likely 2%+ of supply run off from office conversions, which would push the market below 10% vacancy - a really strong number.

So there is a very clear, reasonable path for Manhattan’s office market to become quite tight & LL favorable in the next 5 years.

Realistically I don’t think we get that low. I expect what happens is that you see further SF/employee shrinkage chew into some of these gains, and also that once vacancy falls a few points we start seeing new construction again (I’d guess 2026 or 2027), and vacancy probably bottoms out in the 12-14% range. For our purposes it doesn’t really matter where vacancy bottoms out as once new supply turns back on that means there is a healthy investment sales market and therefore VNO’s share price ought to have recovered.

Induced Demand

One of the good things about investing in a very expensive market like NYC is there are multiple ways to mitigate price declines baked into the very structure of the market. The first is conversions as I laid out in my second article. The second is the concept of induced demand, which I previously briefly alluded to.

The simple fact of the matter is that given it is the most expensive office market in the nation by some margin, there are a lot of users in NYC whose office space square footage is limited by price. So as prices decline, some level of additional demand is induced by the lower prices. By way of example, by adding square footage a firm might allow individuals who perhaps previously were doubled up in offices to have their own offices, or individuals who were in a cubicle to get an office. Or a firm might add additional amenity space.

The price declines the market is experiencing are unprecedented so it’s difficult to say what the demand induction may be, but a few percent does not seem unreasonable. At just 1% per 10% decline in prices, my current underwriting would effectively imply a 3% increase in demand simply from induced demand given my ~30% price discount from pre-covid values. The funky thing here is that rents have not fallen nearly as far as prices, so this is really most true for owner/occupiers, which are a relatively smaller share of the market but still meaningful. My guess is that the induced demand effect is much higher than 1:10, but given the relatively smaller owner/occupier share of the market the net effect is probably 2-3% pickup demand were prices to stay depressed.

Unfortunately given the lack of historic precedence this concept is hard to underwrite, but in my view is highly supported by common sense. Think about NYC housing - if one had the opportunity to magically buy an apartment at a 30% discount to market, would you really reduce your budget by 30%, or would you just buy 30% more house? In lower cost markets (aka most of the country) this really isn’t a thing since most people consume about as much property as they want, but in high cost coastal markets, and NYC most of all, consumption is limited by price.

AFFO

Public REIT investors may have been wondering when on earth I was going to mention FFO or AFFO. As a private investor, I think the wall street focus on these numbers is a bit silly. This is because AFFO gives zero credit to development spend or differentiated distribution of leverage across a portfolio. But most importantly it ignores the private market value of assets (in my view the number one factor when underwriting a REIT). I also get why it’s so popular - it’s an easy crutch to use, just slap an AFFO multiple on a company and call it a day.

So I’d be remiss to not at least mention AFFO. By my estimates VNO is trading around a ~10.9X AFFO multiple. This will change as interest rate increases finish flowing through the portfolio, and the additional Penn district NOI begins to hit. Overall the NOI growth should more than offset the interest rate increases, and the AFFO should get closer to 9.5x.23

Scenarios, Catalysts & Conclusions

So - normally here I’d show some scenario analysis. However given how cheap the stock already is, I’m not sure it’s really worth spending time on the upside. Suffice to say that it’s not crazy that VNO hits pre-covid pricing in 4-5 years, which would be another 2x on the investment (VNO had a $90-95 NAV pre-covid). Even some pretty basic improvements would get you another 1x. This scenario looks even more reasonable in the face of the ~25-30% increase in inflation since pre-covid - if VNO were to hit 2019 pricing in 2028, its ‘real’ price would still in fact be well below its 2019 pricing after factoring in inflation. Real estate typically long term holds its value against inflation after all. So an upside scenario still calls for VNO to be down in value in real terms over a 10 year period.

What is worth dwelling on a bit is what VNO may be worth today to a buyer, and what VNO may look like is a downside WFH scenario.

For thinking about a sale today I’ll be very simple. First it’s worth noting I’m not sure if Roth & current management have any appetite to go private. Roth is getting advanced in years, so it’s not inconceivable he gets sick of the public market discount and cashes out to someone else. But I wouldn’t bet on it.

Still, to go through the exercise - I think a buyer today would want a clear and significant profit. So if I were a big PE fund and considering buying VNO, I’d probably top out at ~$30/share (that’s about a 7.3% cap rate going in) given the current environment, so I could get to about a double in ~3-4 years at a $50 nav + cash flow. Given the WFH risks today a large buyer probably wants/needs a high IRR, thus the buyout price well below my NAV. Still $30/share is a huge premium to today’s share price!

Financing is simply not available for a big office buyout now, so a purchase would be all equity. Luckily VNO comes with built in property level leverage, so there really wouldn’t be any need to issue much new debt for a buyer, so I don’t think debt would be a huge hurdle. So at current prices I do think a buyout offer is possible, but again I’m not assuming it’s going to happen. I think it’s more likely Roth does something creative like a mass asset sale/buyback or special dividend. Hard to say, but at current pricing there are a lot of options on the table

Asset Sales

The other more likely catalyst, as we saw from the market action this morning, is asset sales. SLG has been pursuing this strategy more aggressively, but VNO has stated their intention to do so as well and this is proven out I believe by their huge 350 Park sale to Citadel. If VNO were to sell even just one Penn asset (or more likely, sell a JV interest), it would create an absolutely massive amount of cash relative to their market cap. To do the hypothetical - if VNO sold a 49.9% interest in their big 3 Penn assets, a la what SLG just did with 245 Park, it would generate $10.50/share in cash at my NAV values. As the renovations & lease up are still in progress I don’t think they’d be able to sell quite at that level, but again using 245 Park as a comp they could probably sell a JV in these assets for $8-9/share. Roth has talked about spinning out the Penn assets into a ‘tracking stock’ before, which might have some of the same effect, but I think a JV interest sale would be cleaner. Hard to handicap the odds here, but the longer the stock stays at current levels the greater the odds become I believe.

245 Park on Google Streetview. 12.5 ft ceiling heights, 1967 construction.

Downside

It may sound blase, but it’s really hard to see a downside scenario that justifies today price. Again I spent more time on this in the first article (again link here), but to rationalize todays price you need an absolutely epic decline in cash flows to even begin to make sense. And again - at today’s stock prices (~$15.5 / share), the retail portfolio is worth over half of VNO’s current market cap + corporate liabilities.

As I said before, I think another ~12% NOI decline is a reasonable downside. That moves us from a low 9s to high 7s cap rate. Given where cap rates are on every other asset class, and Manhattan’s historic cap rate premium (justified in large part due to barriers to new supply and the low capex burden relative to values), a high 7s cap is still pretty attractive & I think the private market bottoms out in the low 6s on a cap rate perspective.

The only scenario where you could begin to rationalize today’s prices is worst case WFH + 1970s style inflation, with interest rates just continuing to blow out. Given the recent inflation prints that risk looks pretty low. But still if one were worried about that, it would be something that would affect all of CRE to some degree and you could hedge your exposure there. So it’s really not too relevant for our discussion of VNO in particular.

Finale

I could go on but this article is getting overly long so I’ll wrap things up. Bravo if you made it this far.

In sum:

VNO is trading at a crazy cheap price - low 9s cap rate, low $300s psf to their core NYC portfolio, & ~40 cents on the dollar to pre-covid values (for their core office portfolio). My base case underwriting is a ~30% unlevered decline from pre-covid values, and is over a 3x! The upside could be 4-5x, and it’s hard to see how an investment loses money in a downside. Over 50% of current value is covered by the retail portfolio alone.

Separate from WFH - VNO’s historic pre-covid issues, development, long termism & retail, are all three in the process of resolving. Its developments are finishing, Penn Station’s revitalization is almost complete, & the NYC retail market is in the best place it has been in years. The improvement in the Penn District is a secular trend that provides huge tailwinds to an investment in VNO, regardless of where WFH shakes out.

On the other hand, there is still plenty of uncertainty about the final impact of WFH (the subject probably warrants its own article), potential additional corporate layoffs, or a broader US recession. I doubt short term results show much improvement until 2024. So the investment is not without risks.

However the risk /reward looks very attractive, & the margin for error significant. So for the patient investor I believe VNO offers a compelling opportunity.

Disclosure: Long VNO

This likely goes to a ~9.10% cap rate on future low hanging NOI growth.

Some analysts incorrectly exclude VNO’s Building Management Services income from total NOI. Excluding this income makes no sense - this is fee income that scales with portfolio occupancy. It is consistent and recurring, and is really no different from fee income received by multifamily or self storage operators. It’s a fairly small number so doesn’t make a big difference either way but still.

So technically the $55mm may include the retail component of the Farley building, and this is actually how I value it. If that is the case then the NOI add for 80% of Meta would be more like probably ~$42mm based on their rent and a typical opex. To make it more complicated the issue with typical opex is I can’t figure out what prop taxes will be going forward as the taxes appear to be currently abated as the state econ dev corp technically own the land - my guess is there is some kind of payment in lieu of taxes type fee to the city which is typically how deals like this are structured. As I use the more conservative # in my value this is mostly academic but if it’s the $42mm then same store NOI decline would have been smaller.

There have been a few other small changes to the same store pool but the net effect is minor.

Even a 6% cap rate at a 33% NOI decline would be overly pessimistic, as cap rates on lower occupancy assets are typically lower than fully stabilized buildings given the potential upside from leasing up the vacancy.

The building itself is a bit older, but its location is what is top notch.

If the development proceeds Citadel would lease 55% of the building with rents set by a formula based on construction costs + cost of capital at the time of construction.

This will probably become out of date very quickly, but the latest iteration I think looks pretty cool. It calls for wrapping MSG in glass - NYT story here.

This is probably too in the weeds for anyone who doesn’t live in NYC to appreciate, but Hudson Yard’s transit access really is awful. It’s a full 4 avenues from the Herald Square subway stops. That is further than the UN is from Grand Central, and nearly as far as Central Park is from Grand Central! Yes it has the 7, but the 7’s access is very limited & requires a transfer at Times Square. I honestly think in 5-10 years the Penn District could just completely kneecap Hudson Yards.

If I had to handicap this I’d give it 50/50 odds that Penn manages to close the gap with Hudson and actually becomes fairly nice, vs staying a bit gritty despite all the shiny new buildings. Again my base case contemplates the latter - but it’s worth noting that if Penn didn’t have some draw backs it would if anything get a premium to Hudson once completed due to the superior transit access.

VNO owns 95% of Farley, my numbers are all at VNO’s share.

Interestingly on the Q1 transcript Roth indicated that VNO had turned down a few leases on Penn 2. It may be VNO is waiting for Penn 1 to lease up and the market to recover before actively leasing this asset - it’s a bit unclear frankly.

Replacement cost is thrown around a lot in CRE and is often used incorrectly. This in turn causes many people to dismiss it entirely. The reality is replacement cost is arguably the single most important variable when evaluating CRE, but the key is that it is only applicable apples to apples on new construction. Given Penn 2 is brand new we can actually use face value replacement cost.

For context rents at One Vanderbilt, a brand new tower by Grand Central, are averaging $150 psf. So the Penn district has a lot of room to run if that gap closes.

Ceiling height would be the main knock compared to a new building at this point - most floors are 12 ft which is fine. For comparison One Vanderbilt the new gold standard, is 14.5 ft for most of its space. I’d say class C would be 10 ft or less, B 10-11 ft, & A 11-12 ft+ as rough rules of thumb. As a fun bit of history - the newest nicest building in NYC in 1965 had sub 9 ft ceilings! Higher ceilings didn’t really take off until decades later so 1 Penn actually has good ceiling height for its year of construction. It may seem silly but ceiling height is a key item for office space quality. The lobby is also smaller than you’d go with a new build.

Term through 2098 as fully extended. 75 years is long enough that the value ding isn’t too bad - sub 50 years is really where you start seeing an impact on ground lease knocking up the cap rate a good bit.

Some more detail on my NOI estimates. I am estimating the office is doing $50 psf in NOI after ground lease payments & vacancy, based on $95 psf in rents. Retail I’m estimating at $70 psf in NOI.

Or perhaps more accurately - market conditions have clearly bottomed out and are now improving. Falling knives make investors very nervous, once things stabilize its much easier for participants to underwrite values. It is hard to apply a cap rate to a declining income stream!

13 foot ceiling heights - actually quite nice for its year of construction! It also has a large 453 stall parking garage beneath.

The 7.5% cap rate is somewhat arbitrary given the reduced occupancy levels. What matter is this valuation is a huge 39% discount to pre-covid levels, which were likely over $1.25 billion. I think the Mart has a good amount of potential upside if it ever gets close to pre-covid performance, but there is also potential downside if the building loses its status as a tech hub. So my value is I believe a reasonable base case.

Based on Census data.

One could quibble with this and while the suburbs have a fairly large share of office space in general, their share of growth recently has been very small. And I don’t see any reason to believe that would change soon. You’d need a real decline in NYC’s livability / safety I think for the suburbs to start capturing even their pro-rata share of demand.

Please don’t try to impute the AFFO I’m implying VNO ought to trade for at my NAV - the simple multiplication someone may be tempted to do is incorrect as it includes a bunch of interest payments on assets I give little equity value to. This is why NAV is ultimately a much cleaner measure.

Gotta respect the MSG photo point and joke

Curious why you haven't looked at ESRT as well.. Even more focused on NYC, conversions and has the Observatory revenue stream that the others do not.