Well folks it has been a wild couple of months. I have been busy with new investments and managing my portfolio – apologies for the long delay between articles, I will try to be better on consistency moving forward.

Real estate pricing in the public markets has gotten really cheap, led by a huge sell off in the office REITs. The USRT index (I use this in lieu of MSCI as it’s similar and the data is free!) is almost back to its fall 22 lows, and is essentially flat since 2015, way, way below the S&P which is ~2x its 2015 levels. So you could probably throw a dart at a REIT stock and do OK. But why settle for just OK?

There is lots to talk about across the board in terms of interesting opportunities, but I’ll start off with the office REITs as they have been hit the hardest and are all over the headlines.

But first I’ll point you towards my general disclaimer here. The office REITs I’m talking about today are even higher risk than your average REIT due to higher leverage levels and secular risks from work from home.

That out of the way, in particular I find the NYC focused office REITs, Vornado and SL Green interesting. These companies are almost fully focused on New York office space – SLG in particular is close to pure play although it has a bit of retail and other things. Vornado has a few large assets outside NYC and has a good sized NYC retail portfolio, so its not quite as clean a read on the sector, but the vast majority of its value is still from NYC office space.

Before we get too far into the weeds, I’ll give you the TLDR: NYC office REITS are very cheap, and I believe still have significant underlying value despite what the market is signaling. Why are they so undervalued? As far as I can tell the market is deathly afraid of WFH causing a long term decline in office demand, a la retail and e-commerce from 2010-2020. However this fear appears to be overblown, as the damage from WFH looks to mostly already be done. Further even if the market does stay soft, the REITs are well positioned to outperform due to continued healthy leasing in top tier buildings. To justify current prices there would need to be a ~40% additional decline in NOI, on top of the ~11% decline we have already seen. This is hard to imagine even in a worst case ongoing WFH scenario, and even if a disaster comes to pass, NYC has a unique safety valve which mitigates this risk in the form of office to residential conversions. I’ll cover conversions and valuation specifics in future articles. OK onward to the details.

The NYC REIT stocks have been just hammered recently, and now VNO / SLG are trading at ~9% cap rates1 (VNO is higher, SLG is lower) when you back out development spend & other assets - for example SLG has a book of mezz debt / pref they originate. ~9% is very cheap relative to historical values - NYC prime office has been a sub 5% cap rate asset class since the mid 2000s ( outside of the financial crisis), but WFH is an unprecedented risk the market just doesn’t seem to be able to underwrite.

How bad is it? Well industry heavyweight Vornado is down ~80% over the last 5 years, and ~38% YTD. Even Sunbelt focused Highwoods is down ~53% over the last 5 years.

For more context, the west coast focused Hudson Pacific Properties or HPP is trading at an ~11% cap rate (this is also interesting but they have more WFH risk I think, albeit potentially more growth as well if the tech industry comes back online). Highwoods, the aforementioned sunbelt focused REIT, is trading at over a 10% cap rate. Pretty much every office REIT, no matter what markets they are in, is trading at a very high implied cap rate right now.

Feels bad!

The per square foot (PSF) numbers are extremely cheap as well – SLG/VNO are in the mid to low 300s psf on their core office portfolios. Replacement cost for NYC office is ~$1k psf at a minimum, and more like $1.5k psf+ near Grand Central or Park Ave due to high land values.

So – values are really cheap relative to historical yields and also to replacement cost. These prices really can only make sense if you think (NOI) is going to drop precipitously. Will it? Let’s dig in a bit.

Office 101

First a bit of introduction to the office sector in general – it’s something almost everyone is passingly familiar with, but most people probably don’t understand some of the nuances which are worth discussing in brief.

While there are offices all across the country, there are really only a handful of markets in the US with a really well developed institutional office market. Which is to say a market with a large pool of corporate office users. This is because most US metros actually do not have a very large component of their economy driven by white collar, office using corporations. Instead they are driven by other things like industrial jobs (Greenville or much of the midwest), tourism (Las Vegas or New Orleans), retirees (basically all of Florida), or even lifestyle (any covid zoom town).

It’s worth noting there are a decent number of metros where white collar jobs are a primary driver, but the market is too concentrated in a few large firms, or overall growth is just too slow, for there to be a big office market.

The list of metros with institutional office markets is in fact so short I can name them all here.

Your primary markets are as follows:

Tier 1: NYC, Boston, San Francisco / Silicon Valley, LA, Seattle

Tier 2: DC, Raleigh Durham, Charlotte, Atlanta, Nashville, Houston, Dallas, Austin, & Chicago.

Denver & Salt Lake City are up and coming but still a bit too small. Philadelphia could arguably be tier 2 as well.

Yes, Miami is not on the list. Yes, that means Miami is not a primary office market. It’s growing, but from a small base. For context, based on in house data from our sister company Orda Analytics, Miami has about the same number of high quality office jobs as Charlotte does, despite being more than 2x the population. So while vacancy is low today, there isn’t great tenant depth. Maybe Wall Street relocates to Miami en masse someday, but as of now the NYC relocations are fairly small in terms of actual jobs. The whole office markets worth a damn discussion could warrant its own article, so I will try to not go too far into that rabbit hole here.

So - the institutional office market is something that really only exists in 15 or so of the top metros in the nation.

Leasing Economics

An important thing to understand is the structure of your typical lease. Most offices leases are for a term of 5 years (in NYC its 10 or even longer – a key difference we will come back to in a moment), and involve the landlord either building out a space to a tenants needs, or giving the tenant money to do the build out themselves. The money is called tenant improvement allowance, or TI / TIA for short, and it’s an extremely important part of the office business.

How important? Well TI can be 15-30% of the rental value of the entire lease! An example here would be a tenant paying say $30 per foot net at a new lease for a 5 year term. With 3% escalations that is just under $160 psf in rent received. The TI on a new lease like this could be $40 psf or more, which would be 25% of the rental income just by itself. A renewal, it’s important to note, typically has a much lower TI cost than a new lease.

This TI dynamic makes office cash flows very lumpy, as a large up front cost is paid off over several years. This is why office cap ex is so high – TI is not recorded in NOI (because its so lumpy), and is instead lumped in with capex. If your TI alone is 25% of NOI for a new lease, leasing commissions and actual capex for building repairs can easily push the total burden into the 30s ( this capex burden can be 50% or more in weaker markets like the midwest) during the term of a new lease.

Office’s high capex is in turn why office often has higher cap rates than other asset classes, to yield a similar net cash flow after capex. Many leases also involve some form of free rent, and also require the payment of the leasing agent’s commissions. These both influence net cash as well but aren’t as big as TI.

NYC, as I mentioned, is a bit different. A typical NYC typical lease might look like the following: $60 psf net (after expenses), $110 in TI, for a 10 year lease. This yields a 19% TI burden, compared to 25% in the example above. New development / class A is even better - for example VNO’s new Farley building is more like a 15% TI/LC/free rent burden. A further benefit of NYC when it comes to net cash flow vs NOI (and other high land value markets), is that a larger portion of your value is tied up in the land, and therefore your capex costs are a relatively smaller portion of total value (as capex generally scales with construction costs – so more land value = lower capex as a percentage of overall income, all else equal).

These factors combined mean that NYC office owners typically have a much lower TI/LC/capex burden than landlords elsewhere, and as such, all else being equal, ought to benefit from lower cap rates (which has historically been the case). This is especially true of someone buying a building with long remaining leases in place.

Demand Growth

Office has always been a volatile asset class as corporate demand in strong markets is much higher beta than residential population growth – for example pre-covid from 2013 to 2019 office growth was nearly 3x population growth across a sample of 20 larger MSAs.

In NYC the difference is even more stark - population barely grew from 2013 to 2019 yet office using jobs grew over 11%.

This means when times are good, demand growth is really strong and rental rates can rise rapidly even in the face of significant construction. You may be wondering – if office jobs grew so much pre-covid, how come the office market was doing just OK? For context several office landlords stock’s flatlined from 2015-2020.

The answer is two fold. First office is often easier to build than other asset classes - there is less nimbyism in corporate office districts, and you can build huge buildings. So its difficult for values to rise significantly over replacement cost if you have development land available. Second is that a good portion of office job growth was chewed up in declining average square feet per employee (or a higher density of people in a given office). That density trend appeared to be getting close to an end, but then WFH hit.

The other side of this coin is that downturns are also magnified, as corporate leasing can basically turn off entirely during a bad enough recession, as happened in the GFC. Landlords of leased buildings are insulated from this somewhat by the typical 5 year lease term, but high vacancy buildings can really struggle in downturns.

This demand growth is really critical - office using jobs in general and NYC office jobs in particular, I believe will continue to grow through the remainder of the decade and beyond.

NYC is the global capital of finance, & media, and is a major tech & pharma/biotech hub - so long as you believe those industries (and the world) continue to grow, NYC’s office jobs should as well. Of course the question remains, how will WFH effect how those jobs translate into office space - and to figure that out we need to look at where the market is right now, and what the future may hold.

The NYC Market

The New York office market, like pretty much every other office market, is currently struggling. Vacancy is high by historical standards at ~16%, having increased significantly since Covid struck. However, this is still much lower than many other major markets – for example supposedly hot DFW has a vacancy rate of over 21%. And what is even more interesting, during the last boom DFW’s vacancy never got much below ~18%. In other words, NYC at its worst has a better vacancy rate than DFW at its best.2

It’s worth taking a moment to compare NYC’s office market to others across the country & to discuss some office market history. One of the most important things to know about the office market, especially given the current situation, is that you can still have pockets of strength in periods of general weakness.

This is best evidenced by the fact that we have had long periods of time in various markets across the country where you saw continued construction of new office space (and healthy investing / financing markets for these new buildings), even when overall vacancy rates were elevated.

The poster child markets for this condition are two of the largest growth markets, Dallas / Ft Worth & Atlanta.

As you can see after the financial crisis Dallas’s vacancy remained high pretty much throughout the last decade. And yet construction began to begin again in earnest in 2014, with strong tenant demand for high quality newer assets in prime locations. The same is true of Atlanta. You even saw it in lower growth markets like Columbus Ohio.

So what does this have to do with today’s environment? The answer is that you can have a portfolio of higher quality well located buildings that dramatically outperform the overall market due to tenant demand for said top tier buildings. And with that leasing demand comes investor demand to acquire those buildings at prices above replacement cost. This dynamic is I believe, very relevant to VNO & SLG, who both generally own high quality, well located assets. The reality is - large successful corporations, especially those in NYC, are not incredibly price sensitive when it comes to their trophy headquarters, and will pay up for a quality asset even when they could pay 1/2 as much in a much lower quality building. 3

In Manhattan the best locations are those right next to the major transit centers in midtown (Grand Central and then to a lesser degree, Penn Station), Madison Square Park, Central Park South, and Park Ave. Not coincidentally by and large this is where the portfolios of VNO and SLG are concentrated

And top tier buildings continue to perform pretty well – just look at One Vanderbilt leasing up at record high rents during the depths of covid, or the strong pre-leasing of One Madison Park (these are two brand new buildings built by SLG, accounting for a huge share of the firm’s value), which is ~ 59% pre-leased and doesn’t even deliver until the end of this year. On Vornado’s side you have Citadel committing to a huge lease / purchase option on Park Ave, Facebook signing a full building 15 year lease at the Farley building in the depths of covid, & huge rent growth on new leases at their renovated Penn Station projects.

In other words, there is plenty of historical precedent for SLG & VNO to be able to significantly outperform the overall office market, should the market stay weak for an extended period of time due to WFH.

Recent Results

My intent is to post a full write up laying out the valuation case for either SLG or VNO (I probably will do VNO) in another article, but I’ll touch on their results here.

Vornado just reported earnings with strong New York office leasing of 771k square feet, which is already greater than their entire total from 2022. Occupancy however continued to decline down to 89.9%.

And while this had been previously announced, a joint venture between Ken Griffin (owner of Citadel) and Vornado was closed this quarter on their building at 350 Park Ave. The deal is by any measure a home run for Vornado, and yet the market appears to be giving it zero credit. The terms of the JV are basically that either 1) Ken Griffin and VNO partner to build a brand new class A tower on this site, with Citadel signing a 15 year anchor lease, and Ken Griffin buying 60% of the JV for a land value of $1.2 billion ($900mm to VNO, Rudin also owns some), or 2) buying the site outright for $1.4 billion ( $1.085 billion to VNO). That is either $2.60/share in value (after $360mm in debt on this building), with potential upside from the development (fees, promote & profit, although terms are not disclosed), or $3.50 / share straight up in cash. If Ken sits on the deal VNO also has the option to put it to him for the $1.2 billion price. My estimated value for this building before the deal was announced, by the way, was ~$725mm, and I can tell you that my NAV for VNO is way above the current share price. In fairness this was also all pre SVB, so market values are likely lower now than when the deal was struck but it is illustrative of the potential value VNO holds.

SLG also reported Q1 earnings, and results were fairly encouraging, although nowhere near out of the woods yet. Their occupancy declined to 90% due to a large, already known vacate, but same store NOI was up over 5% and releasing spreads were positive at ~5%. Most importantly leasing picked up, with just under 500k sf of deals signed (close to 22 average, which is actually similar or higher than pre-covid figures but more is needed to bring up occupancy ), and the pipeline grew to over 1.2 million square feet, an increase of 70% vs Q4 2022.

The leasing pipeline would bring occupancy up another ~150 bps if it all gets done (SLG defines pipeline as tenants they are actively trading lease LOIs or lease documents with).

However, these statistics can all be fairly volatile quarter to quarter and deals in the pipeline can fall apart. It’s certainly too early to declare a corner is turned but it looks that judging from the REIT results and overall vacancy statistics (which have been roughly flat since the covid spike) the market is at least not experiencing significant further deterioration.

The Bottom?

The lack of deterioration is really important I believe – as it appears to indicate that the WFH damage is mostly done. We are 3 years into covid & WFH, and the trend now if anything is for more return to the office, not less. Just the other week Lyft, a WFH stalwart, announced a return to the office. This comes after numerous large corporations have announced a RTO, including basically every major bank, most large law firms (both critical for NYC), along with many large firms such as Amazon, Apple, Pfizer, News Corp.. the list goes on. That said we obviously aren’t completely out of the woods yet, as vacancies have not yet begun to improve – however given the recent tech crash & more recently, financial market layoffs, it’s becoming hard to disentangle what is a WFH impact and what’s a vanilla cyclical drawdown. To be clear I’d guess we still have another year or two at least of additional WFH impact, as firm’s whose utilization is down but not enough to warrant subleasing may look to shrink their footprints on lease expiration.

Further boosting the case that the WFH damage is mostly over in New York is that NYC saw a near record amount of office space deliver in 2022. This would be hard to absorb even in a good year, let alone a tech recession added on top of WFH damage. That fact that market vacancy was basically flat in light of all that supply is a pretty encouraging sign.

Now this leveling off is not true of every market – just look at vacancy rates in the tech heavy San Francisco, Silicon Valley, and Seattle markets. Vacancies here continue to rise, especially in San Francisco. The bear case is that WFH damage is not done in these markets, and that we don’t know where the bottom is. The bull case (if you can call it that), is that the recent decline is driven by the tech bust not WFH. There is some evidence to support the latter thesis as vacancy rates started to decline in latter 2021 in Silicon Valley (not visible in the annual data), and leveled off in Seattle, before spiking again in 22. And you could argue SF’s problems are idiosyncratic due to city specific quality of life issues.

A side note – the vacancy statistics I note include sublease availability. So while yes many tenants that have reduced office needs still have years left on their leases, most of these tenants have listed their offices available for sublease, and so this vacancy is already (mostly) captured in the data.

The tech bust brings us to the other major factor that could damage the office market, which is just a good old fashioned recession with its accompanying layoffs and retrenchment. The thing is though, is that it appears that the corporate office market is already in recession. Major employers in the major markets have already announced massive rounds of layoffs. The tech sector is unquestionably in recession. Could more layoffs in other sectors be coming? Sure, maybe, but it seems to me that a large portion of the damage is likely already done, or at least should be done be year end. Just look at this chart of tech layoffs from layoff tracker layoffs.fyi.

And tech isn’t the only industry (although it is by far the largest) - other firms having recently laid off large numbers of workers include Accenture, Goldman Sachs, McKinsey, E&Y, Fedex, Gap & 3m among many others.

What’s unusual here is that the broader economy is still doing pretty well, as the other major legs of the stool, the industrial sector and the US consumer, are still fairly strong. But frankly those are more relevant to the industrial market and the housing / retail markets. In fact we don’t have to look very far back to see a similar recession - the 2001 tech bubble is a close cousin of what we are seeing today. Back then you had an even larger tech/office bubble, so a greater decline than we are seeing, and moderate industrial weakness, offset by a strong consumer. It remains to be seen if industrial or the consumer also weaken, or the damage stays limited to the office sector.

In fairness most of this data was from before SVB and the regional banking crisis - which is a potential contagion vector to the financial sector and the rest of the economy. These may be famous last words but it looks like that crisis is mostly contained with the federal government clearly willing to step in and stabilize the system. Still, I’d wager we see a few more failures as a couple of banks look to have little to no equity after marking their HTM loans to market. Critically unlike 2007 the problem primarily appears to be one of duration, not credit risk. I’m sure there are credit losses coming (especially office, but office always causes big losses), but the reality is the banks have been much more conservative in their lending standards so its hard to see loan losses getting anywhere close to financial crisis levels. The old adage seems to be proving true, in that the generals were busy fighting the last war and ignored an entirely different set of risk factors. But who knows where this will shake out - I wouldn’t be shocked if we had further office deterioration with more layoffs later in 2023.

WFH’s Impact Thus Far

So - the NYC leasing market is currently struggling, and has been since Covid. The market appears to have stabilized with decent tenant activity and leasing, but hopes of a recovery have been stymied by the tech slowdown and general recession fears. However the investment markets appear to be pricing in significant continued declines in income, based seemingly on large fears around the impact of work from home (WFH). These fears appear to be misplaced, as it looks like the damage from WFH is mostly already done.

SLG/VNO & the overall market have already taken a pretty big hit from the WFH decline. This crisis didn’t happen yesterday, we are now a full two years into the current level of vacancy. Using SLG as an example, it’s difficult to say exactly how much incomes have declined, as the asset pool has changed recently (selling deals and new developments coming online), but after normalizing to the pool of buildings SLG has held since 2019, it looks like occupancy is down about 8 percentage points, which would mean incomes are down ~10-12% due to operating leverage. VNO, by the way, is quite similar with about a 7% occupancy decline for their NYC office portfolio.

Ultimately though its difficult to say with confidence exactly where the final impact of WFH will shake out. Its a hard to quantify risk factor. Here’s how I try to frame it. I think WFH is clearly a one time destruction of demand, that is playing out over a period of time. The question is how much demand and how many years?

The relevant data we can review are vacancies, total office using jobs, and utilization.

Vacancy we have already covered, so I’ll hit the other two here.

First - jobs. As you can see below, NYC has already fully recovered (and then some) its covid job losses. So that’s simple enough - office using jobs are higher than they were pre-covid. This is obviously a positive for office space.

Chart is not seasonally adjusted which is why it looks like a drunk drew it, jobs in millions.

The final thing is utilization.

Everyone is very hung up on utilization, but I place less emphasis on it than others. Partially this is because the RTO situation is still fluid - companies are still changing their policies (almost universally towards more in office as far as I can tell), and there can be a big lag between policy change and actual attendance. Again to use Lyft as an example - they are going from fully remote to 3 days a week in the office mandatory with a 4th recommended, but its not taking effect until Labor day.

The other reason I’m less focused on utilization is because we don’t know how to translate utilization levels to a given occupancy. On the one hand this is scary, and if you just crudely extrapolate a 50% utilization rate into a 50% reduction in demand its easy to think the apocalypse is nigh. We can try to put some parameters around it - obviously companies with 4 and 5 days a week will not shrink their office space. 3 days logically should also be fairly safe - at 3 days assuming you want all your employees there, you still need 100% of your pre-covid space. 1 and 2 days is where it gets tricky - what kind of size reduction does this warrant? Ultimately we just don’t know. I could see some companies reducing their space by half, but I could also see a firm rationalizing keeping all the space so everyone can be together when you are in the office. Or perhaps a firm shrinks but trades up for higher quality space The reality is the reduction is going to vary from firm to firm.

This is why I’m much more focused on vacancy, and jobs to a lesser extent. In the vacancy rate, we can see what companies have already decided to do with their space needs. So in other words, after enough time has passed, the vacancy rate (plus jobs) will fully reflect whatever firms ended up doing with their space. As I mentioned above, given we are 3 full years into a post covid world, I think its reasonable to believe that at this point most firms, if they were going to get rid of space, have already done so, or would have put it up for sublease. Not all, but most.

The Downside Scenario

However – seeing at it appears to be the primary fear (and in fairness it is a big, difficult to quantify risk), let’s play around a bit with what a worst case continued WFH scenario could look like. This is your downside scenario (plus an even greater corporate jobs recession). If you do not believe most WFH damage has been already done, then its reasonable to ask - how far along are we? I believe a conservative downside scenario to examine would be to assume that we are only halfway there - that somehow, half of all WFH occupancy loss, still has not occurred yet despite being 3 years into this new world.

This would mean we mark down NOI by another ~12% (slightly higher than before because office’s cost base is relatively fixed, so the linear revenue loss yields a disproportionally higher NOI loss4). This means our current ~9% cap rate drops to a 7.91%, and would be a full ~22% decline from pre-covid income.

Its worth noting that the financial crisis, which decimated NYC’s primary industry of financial services, only generated NOI declines of about ~8% - so we are already worse than that, and this downside scenario is basically a financial crisis times 3. That is a hell of a downside!

How does that compare to the rest of the market? Well if you assume multi is ‘fairly’ priced, at a ~5% cap rate with ~20% capex burden5, we get around a 4% true cash yield. Again you could argue if this number is right or not, but its roughly where the private CRE market is today and there are bidders in the good markets at these prices (weaker markets have higher cap rates).

Office’s capex burden is higher than multi, although the NYC landlords have traditionally been lower than others due to their very high PSF values (reducing capex’s relative burden as much more of the value is in the land), and their longer WALTs. This is another area where some folks will disagree – but if you look at SLG/VNO’s historical total recurring capex burden it averages around 25% over the most recent cycle.6

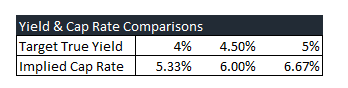

So to get to a 4% true cash yield, we’d need NOI at a 5.33% cap rate (4% yield / 75%, or 1-capex) for class A buildings in NYC (lower quality buildings should have higher cap rates as their capex as a share of NOI is proportionally higher and tenant demand is usually weaker). To get to a 5.33% NOI yield, you’d need today’s NOI to decline by a whopping ~40%. So the market today is pricing in a 40% NOI decline, or some combination of NOI decline and a higher true cash yield. Even in the conservative downside scenario, 5.33% is a whopping additional 32% decline in NOI from current yields.

The ’proper’ yield for real estate given interest rates etc is too deep a subject to get into here (Another thing which deserves it own article), and I know some people are going to protest about this assumption, but again this is roughly where we are today in the private markets, which is the lions share of the CRE world. And what’s most important here is the scale of the margin for error – even if you assume some level of additional yield re-pricing without offsetting income growth (and in theory in an inflationary environment which would justify the higher yields you ought to get some income growth – of course office won’t benefit from higher incomes until the supply demand dynamic is better), you could easily eat a 50 or 100 basis point increase in yield with zero offsetting income growth and still have a lot of margin left over.

Table is for NYC office

For the sake of argument I’ll illustrate this a bit – if you assume multi cap rates ought to be 6%, which is where the multi REITs are trading, (a full 100 bps increase, or another ~17% decline in prices!), then class A NYC office ought to trade around a ~6.4% cap rate (6%*80%7 is 4.8% true cash yield, 4.8%/75% = 6.4%). There is still a huge gap between 6.4% and current yields for SLG/VNO – a 6.4% cap is a 29% decline from a 9% cap rate, and is a healthy 150 bps below our worse case WFH scenario of a 7.91% cap rate.

A couple of other errata: it goes without saying that new supply growth is falling off a cliff. The extremely long lag time to delivery means the current wave is still not quite completed, and the propensity to build new headquarters buildings (see JPM and Citadel), means its never going to zero, but overall new supply growth should reduce dramatically for the rest of the decade. People forget that as a producible commodity, real estate markets self stabilize. This reduced supply will begin to help the office market in 2024 onward.

Also - the NYC office market benefits from a special safety valve to balance supply that very few other markets in the county can tap in to, and that is conversions to residential. This is something I’ll dive into more in the next article.

Another item worth touching on is the availability of debt, which is a key component of CRE capital markets. Right now lending activity on office is pretty constrained given all the negative sentiment. However lenders as a whole have pretty short term memories, and I’m quite confident that so long as top buildings continue to perform well from a cashflow perspective, there will in turn be investor interest which will in turn drag lender interest along with it. A great example of this is what happened in hotels only just recently. As covid slashed hotel cash flows, hotel lending dried up to basically nothing. And yet here we are only two years later and the hotel lending market has thawed out, as there remains a healthy buyer interest in the asset class.

Conclusions

Adding it all together – it’s difficult to foresee a scenario where the pricing on NYC office REITs is anywhere close to correct. You’d need a huge additional WFH impact beyond what’s already happened, limited office job growth going forward, and basically no conversions of office to residential. And at current implied pricing the only way that happens is NYC residential demand also falls off a cliff.

It is worth reiterating the risks here again - I may well be underestimating the impact of WFH, and given the leverage levels involved there is real downside risk here. A broader recession would also be very painful for the office sector (but this is true of many sectors so isn’t a risk unique to office space). All that said, overall I believe the risk / reward ratio is quite favorable.

This article is already getting pretty long, so I’ll pick up next time with some detail and analysis on the much hyped subject of office conversions. Then I’ll dive into specifics of valuation for either VNO or SLG (probably VNO as its cheaper and Steve Roth is an interesting guy).

As a refresher cap rate = net operating income (NOI)/value, roughly analogous to current unlevered yield.

I think this are a few reasons for this. Clearly DFW has more per capita job growth, however its generally much easier and cheaper to build a new building in DFW, as compared to New York where land is very expensive and only the largest and most well capitalized developers can build something. New York’s extreme expense also helps cushion downturns - as many tenants have been and continue to be priced out of New York. So when prices go down there may be an induced demand effect where users who otherwise would have left may stay around, or users who have the money decide to keep the same budget and just buy more space. Whereas in DFW if demand & rents decline landlords are pushing on a string - no tenants are leaving Dallas because its too expensive, and office densities are generally lower in DFW so there is less propensity to upsize given cheaper prices.

The reality is those price sensitive users left NYC long ago - you can see it in the massive back office operations the various mega banks have opened across the country in low rent locations (JPM in Columbus, Goldman in Dallas / SLC, Citi also in Dallas, and arguably the entire city of Charlotte).

This is likely conservative as the two biggest expenses for offices, taxes & insurance, actually do scale with values, and in a scenario where values decline these should actually decline too.

Top quality multi / high value coastal multi has arguably an even lower capex burden due to the aforementioned capex share of NOI scaling downward as land values increase.

Other public CRE analysts disagree here, but I believe they are shortsightedly lumping development and redevelopment capex into the overall total. SLG and VNO are very active in development/redevelopment (I haven’t run the numbers across the whole sector but it wouldn’t surprise me if they are the two REITs most heavily involved in development), so this skews the numbers significantly. Some would argue that the REITs unfairly hide certain ‘refresh’ capex in the redevelopment category (like a lobby upgrade for a building they have owned for a long time), but this number just doesn’t appear to be that large. SLG breaks it out and it would only add another ~1% to the 25% I cite above. The minimal sizing of this type of capex also just flows from actual real world experience with office buildings, which most if not all of said public analysts lack. The reality is the main place you do a cosmetic refresh in an urban office building is in the lobby, your amenity space and new cladding in your elevator cars. This kind of refresh just doesn’t cost that much money. Anything larger scale than that (such as re-skinning the exterior, or adding a huge new amenity package), should definitely be classified as a major redevelopment, and would be silly to classify as recurring.

80% is just 1 minus the 20% capex burden for multi. This is how you’d calculate true cash yield (some call it economic cap rate) - NOI minus recurring capex. We express the capex burden as a percentage of NOI to simplify the math.

Its always possible but I think the risk is low. Many generalists misunderstand how REIT debt is structured. The vast majority of the debt for each company is property level and not recourse to the parent company. For example VNO has about $2.6 billion in corporate debt vs $1.3 in cash. They have plenty of unencumbered assets - most notable is the Farley building which they have spent $1.1 billion on and is leased to Facebook for 15 years (low 6s yield on cost). So just one building + cash covers basically all of VNO's corporate debt.

Fantastic article, thanks for sharing. I agree with almost everything but have 2 questions

1. If the structural decline in demand from WFH is realized as leases roll off, why is it crazy to assume we're only halfway through given the avg oREIT WALT?

2. Good chart on tech layoffs. While I realize office-using employment is white collar vs. total employment, it feels like we have a ways to go for currently record-low levels of unemployment to normalize on the back of Powell's hiking cycle

Those are my only 2 areas of pushback. Thanks again, great article