Warden Q2 letter

General real estate market commentary

In lieu of an asset class or company specific post I thought I would share the recent Q2 letter for Warden’s public equities manager (sent out July 7th). I’ve removed the return information as it is my understanding that this cannot be disclosed to unaccredited investors & I don’t have a way to filter that on here. If you are accredited/institutional and curious feel free to reach out.

Market Commentary

Broadly speaking – in the CRE world (and probably across the whole economy) the biggest trend this quarter in my view was stabilization of the capital markets, something which is still ongoing. After freezing up almost entirely after the banking crisis in March, liquidity has slowly begun to return to the markets. This is probably most evident in the CMBS market, with $5 billion of deals pricing in May (vs $8b before May, most of that pre-SVB), and several more deals in the market now or soon to launch.

Bank lending continues to decline as of the May data, with total loans down nearly 2% since January. However all things considered this is not a terrible decline, and the rate of decline has itself been slowing recently.

On the inflation front – recent data has been quite favorable. Here is a table showing the most recent figures for May from the economist Jason Furman.

There are many different ways to slice the inflation data, as you can see in this chart. In my view the most critical data points from an inflation perspective are core goods and services – as energy, food & housing are all very volatile and in the short run are often driven by factors completely unrelated to inflation. I also like to look at overall core inflation with private rents (as the Census measure is lagged), and then also excluding housing and used autos given their covid driven bullwhips.

As you can see above, these measures are running 2.5-3% for May and 3-4% over 3 months, down a good bit from the 6 and 12 month averages which is great to see. It remains to be seen if these trends continue, but if we get back to a ~3% inflation world by the end of 2023 it could have very big repercussions for interest rates and cap rates.

And particularly relevant for real estate, it looks like construction costs continue to be running flat with minimal overall escalations. Certain items (electrical) remain on long lead times, but the market appears to be normalizing for many other trades.

Even better the risk of recession appears to have declined somewhat. Contagion from the banking crisis has been relatively limited, and a true financial crisis appears to be off the table (at least for now!). Economic data continues to surprise to the positive with its resilience.

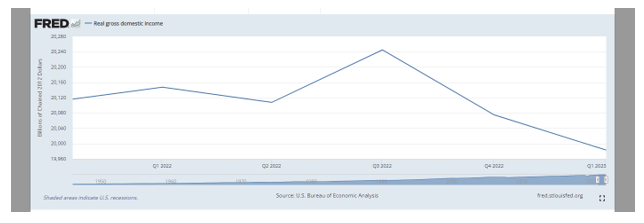

One interesting way to view the last few quarters is that the economy was essentially in a recession the last two quarters, and may now clawing its way back out. A ‘recession’ with 3.7% unemployment doesn’t make a ton of sense at first blush, but if you look at real GDI data (essentially an alternate measure of economic growth to GDP), the economy would be in a recession the last two quarters, and also down over the last 5-6 quarters.

GDI and GDP ought to match (they are two sides of the same coin, essentially two ways to measure the same thing), but strangely they have been very far apart recently. This implies something is wrong with one or both of the measures. If you average the two together, the economy would still be in recession the last two quarters (by the technical two quarters of consecutive economic decline measure). However it’s worth noting over the last 12 months GDI + GDP averaged is slightly positive as Q 3 2022 was hugely positive.

Along with these interesting trends in GDP/GDI, the economy has seen a pretty large decline in productivity of 2.33% since Q2 2021.

The typical pattern is for productivity to rise significantly during/after recessions, and then slowly continue to grow. We saw the typical rise during the Covid recession, but very unusually productivity then began to decline.

A pet theory I find interesting, which would explain a recession without a decline in employment, is that we have been in a productivity lead downturn. A productivity recession would have lots of interesting, unique characteristics. The most notable is that it could occur without a large decline in employment – as if you keep workers constant but output per worker declines, overall output would decline. Whereas in a typical recession, employment declines along with output because much of the output decline is driven by lower employment.

A productivity recession would also be inflationary – as the economy would produce fewer goods and services per person, thus effectively driving up the cost of those goods and services holding money supply equal.

So, a productivity recession could explain how the US economy has such strong employment (the traditional marker of recession), yet it still ‘feels’ like we are in a recession, with earnings down, & office demand weak.

What has caused the large productivity decline we saw recently? I don’t think anyone really knows at this point, but I would put forth a theory that it could be working from home. After all what other large-scale trend have we seen other than WFH which conceivably could have such a nationwide impact?

Data on WFH is still mixed, but the most recent and highest quality study from U Chicago economists Gibbs, Mengel & Siemroth shows a clear productivity decline of 8-19% for higher level knowledge workers. Study link is here, I highly recommend taking a read of at least the summary. It’s the first full non survey study of higher skill employees – previous studies were based on self reported surveys or workers doing narrow rote tasks (call centers and patent processors in particular), and so in my view were not as robust.

This to me just makes sense at a very basic level – it is easy to be distracted at home, and there is far less opportunity for collaboration & serendipity while remote. Don’t get me wrong, WFH is very convenient! But it may have a hidden cost in the form of lower productivity.

Coming back to our portfolio - regardless of whether the US was in a recession or one is still coming soon, I believe our portfolio is very attractively priced and we are being amply compensated for any risks of downturns in demand or reductions in liquidity.

On to the sector specific commentary

Office – for more in depth office commentary, I would point you to my recent Substack articles (link here). Office was a big drag on our performance in Q1, but in Q2 I re-allocated more investment into the office REITs at close to the most recent lows, & office has been a major contributor to our strong Q2 performance. VNO & SLG in particular have had a great last few weeks due to a strong private market sale of a JV interest in a class A office asset at 245 Park Ave by SLG. This is arguably the first class A asset sale in NYC since rates have risen significantly, and as such is a key marker of private market values. The sale price was above my NAV for SLG, which is itself massively above the current share price, and I believe generally affirms my pricing for the two NYC REITs. The office market is not out of the woods yet but hopefully more good things to come on this front.

Retail – Macerich remains our favorite retail investment and is a key holding. Mac had a great Q1 & yet continues to get no credit from the market. You can buy Macerich at a ~8.7% cap rate with strong baked in income growth from signed but not opened leases, and likely further growth to come.

The retail leasing market continues to be quite strong, especially in the A box space. The reality is that there is just very little vacancy among quality boxes. The recent bankruptcy of Bed Bath & Beyond is a great example of this. While BBY is a large retail tenant, and obviously a big retailer going BK and liquidating is bad for the market, by and large landlords have been able to easily replace BBY, often at higher, accretive rents! In other words, the market is so strong that losing a major tenant like BBY is actually a financial positive for many landlords. That hasn’t been the case for nearly 20 years.

Tenants are also aware of this dynamic - during the Bed Bath & Beyond recent bankruptcy auction, bidders paid to assume over 100 over BBY’s leases out of 153 leases brought to auction! It is my understanding the auction only included Bed Bath stores, not BuyBuyBaby, whose results should be out soon1. This isn’t unprecedented, it’s common practice to auction off leases in BK, but what’s telling here is the number of bids already received. For comparison in 2017 during the Toys R Us bankruptcy it looks like only 67 store leases were assumed out of ~270 auctioned (and ~500+ total leased). With BuyBuy to come and a potential second round auction upcoming, it looks like we could easily see 2x the interest in Bed Bath’s stores vs what Toys received in 2017, and potentially much higher depending on how future auctions shake out.

Strength in the A box market this is also evident just listening to the retailers themselves. Here’s an excerpt from Sportsman’s warehouse from April, on competition for retail space.

Multiple retailers bidding on empty spaces – again this hasn’t been the norm since probably 2015!

This strength in the box space is very beneficial to Macerich, given the number of large department store boxes they own with very low rents. It makes re-tenanting these spaces much easier, and is even shifting some demand into the B & C box space.

This is evident in MAC’s Q1 results – occupancy increased 90 bps YoY and was only down 40 bps QoQ (there is typically a seasonal decline from Q4 to Q1, and was often over 100 bps pre-Covid). SS NOI was up a solid 4.8% YoY. Retailer sales per foot continue to grow, up 2.7% YoY and consumer spending remains strong as seen in the chart below.

The key thing here though is really the going in pricing. To demonstrate this, lets look at MAC’s current NOI yield vs Prologis’. Mac is trading around ~8.7%, while PLD is at 4.2%. Over a 10 year hold period, assuming MAC can grow NOI 3%/year, PLD will need to grow its NOI/year a whopping 10.75% per year to just pull even with MAC.

Now – PLD’s mark to market on their in-place rents apparently is in the mid 5s, so the first leg of growth one could argue is already is baked in. The problem is PLD needs to double rents over 10 years even after marking its rents to market. The industrial market is strong but it is a real stretch to see this coming to pass. One of the biggest issues is that industrial values are already close to the levels necessary to justify new construction – and industrial is historically the CRE sector where it’s easiest to build. So it’s hard for me to see such massive price appreciation in the face of ready new supply without corresponding further large increases in construction costs (recent large increases are helping support the current bout of rental rate increases). Even in the infill coastal markets if prices rise much more you can start to rationalize multistory industrial buildings (there are not many in the US but are not uncommon in Asia), which unlocks a whole new world of potential supply.

One could argue that malls warrant a higher cap rate due to a higher capex burden, but I think this view is largely misplaced. Malls current relatively higher capex burden is driven by redevelopment of anchor department store boxes. There are only a finite number of these boxes and many have already been redeveloped - as box redevelopment slows down, which is starting to occur, I believe this perception will fade.

I view the box redevelopment cycle we are in as a once a 30-50 year event (this is about how long many dept store boxes lasted), and once this wave is completed mall sector redevelopment capex should drop significantly. Historically malls commanded the lowest cap rate of any asset class in part because they had one of the lowest capex burdens.

Hospitality

On the hospitality front, many hotel REITs continue to trade at interesting valuations well below replacement cost and values even 6-7 years ago.

Across the board the hotel REITs posted solid Q1 results, and it looks like overall the industry should get back to 2019 income levels this year. A split remains between resort/leisure hotels, which are ~10-20% above 2019 levels in terms of RevPar, and more urban/business hotels which are still a bit further behind. But critically business & group travel continue to improve – with business RevPar at Hilton now up 4% in Q1 over 2019, driven largely by higher rates, and group travel RevPar reaching 2019 levels in the first quarter. Reservations for all segments remain strong and it looks like business/group travel are continuing to recover and converge on the strong leisure segment, rather than leisure falling down to the group/business level.

This is really important – it means that going forward urban hotels should hit 19 levels of income soon, and likely have a path for continued growth thereafter as business/group travel continues to recover. Also across the board international travel is still below 2019 levels, which is another strong growth tailwind for the industry as this important sector continues to recover.

So the main thing holding hotels back from 2019 values (which were not particularly strong), are cap rates, which are obviously higher today.

I believe given the surge in construction costs from 2019 to today (~30% higher), continued demand growth, and higher cap rates, that the whole hotel sector should have a continued strong income tailwind for the next few years until asset values can justify new construction in major urban or resort markets. This likely occurs via continued income growth, although of course cap rates could also fall. Either way I feel confident that hotel values in the public markets have room to run.

In our portfolio the biggest piece of news is the decision by Park Hotels to walk away from two large SF hotels which have a big CMBS loan maturing later this year. The San Francisco market appears to be uniquely challenged for hotels (similar to office space), and while you never want to applaud a foreclosure action I think this is a good move by management. It’s also a good example of how silly Wall Street’s focus on total debt level / earnings levels are for REITs – by handing back these hotels Park will dramatically improve its cosmetic overall debt to income ratios, as the hotels currently have zero earnings against their significant debt.

More importantly, by walking away from these hotels, Park is able to forego the significant cash equity infusion these assets would have required to refinance the debt. With nearly 30% of its market cap in cash on hand, Park has a lot of optionality to create value through share buybacks or corporate debt paydowns (Park has a $650mm 7.5% interest rate loan it took out during Covid that would be a great candidate).2

A final note on the hospitality sector. Cap rates have held up a lot better here than other asset classes because hotels never experienced the ultra low rate driven surge in values / fall in cap rates other asset classes did. Pebblebrook sold two Seattle assets in May for mid 7s cap rates on 2019 numbers, which is a really strong value especially given the assets are still performing way below 2019 levels. On an after capex basis hotels are offering one of the best real cash yields in commercial real estate today, which combined with a healthy growth profile from group/business/international normalization makes the overall asset class quite attractive. Yes a recession may dent earnings in the short term but the fundamental value imbalance against replacement cost will remain & will eventually normalize.

Industrial

Industrial real estate continues to have the strongest fundamentals of any asset class due to strong leasing and rent growth. As an indicator of just how far ahead market rates have gotten vs in place rents, just take a look at the recently announced huge Prologis/Blackstone deal. PLD is buying a 14mm sf portfolio for $3.1 billion, at a 4% cap rate going in & $220 psf. I haven’t found great information yet on where the majority of the assets are located as a bunch of markets are mentioned, but a 4% cap rate is pretty strong even for coastal markets let alone non coastal. However PLD notes in their press release that the portfolio would be a 5.75% cap rate at market rents. This is a huge in-place to market spread, and is actually fairly close to the implied spread in the rest of PLD’s portfolio.

The real question is where the leasing market goes from here. Again PLD is a pretty good bellwether here – as recently as April they were still estimating US rent growth for their portfolio to be 10% for 2023 (PLD skews coastal, total US probably running a bit cooler). As far as I can tell, the industrial leasing market has softened up a little bit since Q1 but not significantly (much of the softness is in the mega box space & also apparently So Cal has weakened a good bit).3 Vacancy has continued to creep up in many markets, but is coming off essentially an all time low & so remains at fairly tight levels. Take DFW as an example – per the latest report from Cushman & Wakefield, vacancy has ticked up to 6% thanks in part to significant new construction, but remains below pre-covid levels.

It remains to be seen where we go from here. The Logistics Managers Index, which is a monthly survey of logistics users, shows that inventory levels are decreasing and overall warehouse capacity is increasing – both of which would have negative implications for leasing of warehouses. However – firm’s 12 months expectations are for a return to growth & this can be seen in the continued leasing of warehouse space (visible in the index in the Warehouse Utilization category).

So – it’s hard to draw strong conclusions from the survey data. However if user’s forecasts of a return to growth are incorrect it could translate into a healthy decline in warehouse demand moving forward.

Most relevant for us, the public industrial market continues to trade near private market NAVs by and large. And I think overall industrial as a sector has a fair balance of downside and upside risks. Strong embedded asset rental rate growth and continued market rent growth is balanced against significant new supply which requires strong ongoing demand, which appears to be softening a bit. However warehouse starts fell off a cliff this year due to the spike in rates & the banking crisis, and if construction starts remain depressed it could be quite bullish for industrial owners over a 3-4 year period as the supply risk declines.

As I mentioned in my Q1 letter, we have taken a position in a smaller REIT in the sector which is trading at a significant NAV discount due to certain firm specific issues. As this letter is getting fairly long I may try to give that investment a full write up on Substack at some point rather than dive into it in the quarterly letters.

Multifamily

Given the attractiveness of other opportunities, I have reduced our multifamily exposure. Many multi REITs continue to trade in a 5.5 to 6% cap rate range, a decent clip below private market values which are more like +-5%. I continue to look for more idiosyncratic opportunities in this sector, similar to our AIMco investment last year.

What’s interesting here is that the private market continues to have pretty solid liquidity, at least in certain markets & relative to other asset classes. So apartment REITs probably have the clearest path to sell assets at NAV to generate positive returns for shareholders, if management were so inclined (which they usually aren’t).

The recent mega buyers, BREIT and Starwood’s private REIT, continue to be sidelined by significant redemptions. At BREIT for example, Blackstone only filled about 17% of redemption requests in June, which while down a good bit from its peak in January, still represents a pretty significant potential shrinkage to reckon with.

Overall new supply remains significant, and many markets are starting to feel the pressure. Supply should eventually ease up as developers have slowed new deals, but the backlog of permits in the queue and extended construction times means many deals that were capitalized in mid-2022 are just now breaking ground, so construction starts have not slowed much.

As such rental growth is running below pre-covid averages in most markets – see below chart from Jay Parsons over at Realpage (one of the better multi data providers).

Storage

We do not have any positions in the self storage market. Market fundamentals remain fairly strong in most metro areas, but public discounts to NAV are not significant & as of yet nothing here has really caught my eye from a value perspective, at least compared to opportunities in other sectors. Given the small number of REITs in the space (which are all pretty large) and their relatively low leverage levels, this sector generally isn’t set up as well for interesting niche opportunities for value.

Conclusions

In sum: a lot going on in the CRE markets (as always feels like the case recently). The next several months will be interesting to see if inflation continues to cool, and where economic growth goes. I am hopeful recent positive trends on both fronts continue, but I don’t think we are out of the woods entirely yet. Regardless of macro fluctuations I think our portfolio is well very positioned and I am quite excited about our prospects over the next 2-3 years. As always, please do not hesitate to reach out with any questions. I appreciate your trust in me.

Best,

Hawkins

Update since I wrote this - the BuyBuy auction was cancelled. I believe the original auction was for the entire chain, and that there wasn’t sufficient buyer interest in buying the entire thing. Its a bit unclear to me what the next steps are but I would assume that at some point they run a lease auction if they can’t find a buyer for the whole thing.

An in the weeds note not included in the original letter - by handing back the hotels Park will incur some phantom taxable income, and so a portion of the cash on hand is earmarked for a special dividend to true this up. Park estimates this to be $150-175mm.

Update: PLD reported Q2 earnings and sure enough have now reduced their FY rent growth forecast down from 10% to ~8%. They wouldn’t breakdown the forecast by region but admitted to significant market rent growth weakness in SoCal, formerly the hottest of markets.

Couple of post script items I neglected to add in my original post.

First - I should also note the inflation data for June came in really favorable as well (this data was released after my original letter). This is CPI, which is slightly different from the PCE data I shared. When looking at it with private rents this measure actually went negative ! 2 months still doesn't make a trend but looking promising, & given what I'm seeing with sunbelt multi rents the shelter element should continue to provide tailwinds (not that it helps us New Yorkers right now...)

Second - Somewhat related to the above, I probably ought to have mentioned the significant outperformance of coastal multi REITs vs sunbelt. This is something I predicted back in 2022 given relative pricing and relative supply pipelines, and we benefited from this trend. NYC in particular being a really strong market, although SF remains soft. Some sunbelt markets are YoY asking rent negative