Warden Q3 Letter

It’s Q3 & we all know what that means - quarterly update season. So I thought I would share the Q3 letter for Warden’s public equities manager in lieu of an article this week. Again, please see my general disclaimer HERE. And also returns have been removed as I have no way to filter on accredited status so, if you are accredited/institutional & curious please feel free to reach out.

Market Commentary

Generally speaking – the quarter felt relatively stable up until the second half. Rates had stabilized, & buyers were re-emerging as the world calmed down after the mini banking crisis in the spring.

But as of this writing the 10 year treasury has spiked to ~4.65%, with a peak near 4.9%, up from ~4.3% only a few weeks ago. This is a large and rapid increase, & this kind of volatility creates difficulties in the lending & investment sales markets.

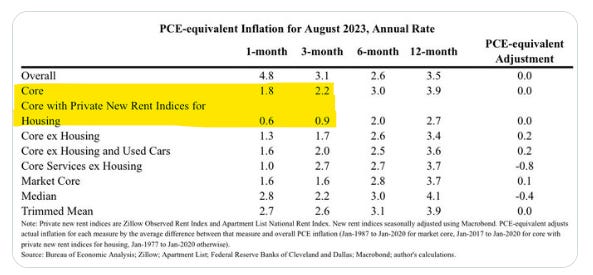

For much of the year the story with interest rates has been one of inflation, with the Fed tightening to try and bring down inflation. What has been odd about the recent rise in rates is that the last 3 months of inflation data have been really good. The last 3 months are around 2%, and when you swap in private market rents (as a reminder the govt measures are highly lagged for housing), it’s only about 1%, well below the fed's goal.

Here is a chart from the economist Jason Furman (give him a follow on Twitter) on August PCE (the Fed favors PCE over PCI) which breaks things down nicely.

And here is September CPI, which just came out & has been running a bit higher than PCE (August PCI Core was also in the mid 3s) but is broadly similar with very low rates when you use new rents instead of the Census’ lagged measure.

Not to get too far into the weeds here but on the negative it’s worth noting that used cars dragged down last month, and that Core Services ex Shelter remains fairly high, driven in large part by car insurance and hospital costs. But those items have a combined 5% weighting so getting really into the nitty gritty there & I’m hesitant to read too much into one or two line items.

So while it’s still too soon to declare victory over inflation, the data nonetheless look promising over a 3 month and even on a 6 month basis. Housing should continue to provide a tailwind for lower inflation given the lagged government measures that will continue to come down over the 6-12 months.

Yet despite the benign news, interest rates have spiked. What gives? Frankly I don’t know, but there are a number of theories out there. One is simply supply. US treasury issuance has skyrocketed since the middle of 2022 as the deficit remains wide and the Fed winds down its balance sheet. August was a particularly large month for issuance. However much of the increased issuance is at the shorter end of the curve, whereas rate increases have been largest at the long end, so I’m not fully convinced this is the answer.

Source: SIMFA, US Dept of the Treasury. Note: Issuance was far larger in 2020 due to pandemic stimulus but the Fed also bought a massive number of treasuries that year & there was a lot of demand for risk free assets given the pandemic.

PS: The following chart I have added for clarity showing Fed treasury holdings over time – really it’s the combination of increased issuance and declining holdings that some theorize is the issue.

Regardless of the cause, continued increases in rates is not great news for the already beleaguered CRE markets. The one silver lining is that as rates go higher these moves become less extreme on a percentage basis, and their relative impact gets smaller. A 75 bps move from 1.5% to 2.25% is a gargantuan 50% increase, while going from 4% to 4.75% is a more manageable ~19% rise (though still quite a bit!).

So the relative impact on cap rates shouldn’t be quite as large as prior spikes (if this one holds). But now fundamentals are softening in certain sectors, most notably multifamily, meaning the potential to offset a rising cost of capital is diminished in the near term.

At the risk of sounding like a broken record – the public markets continue to react to these changes in interest rates almost as if real estate is just a bond with a fixed income stream. But that is not correct over the long run. As I have said many times, the long run pricing of commercial real estate is determined by supply and demand, not interest rates. If interest rates are higher, cap rates will be higher, but eventually incomes will rise enough to compensate and justify new construction so long as there is sufficient demand.

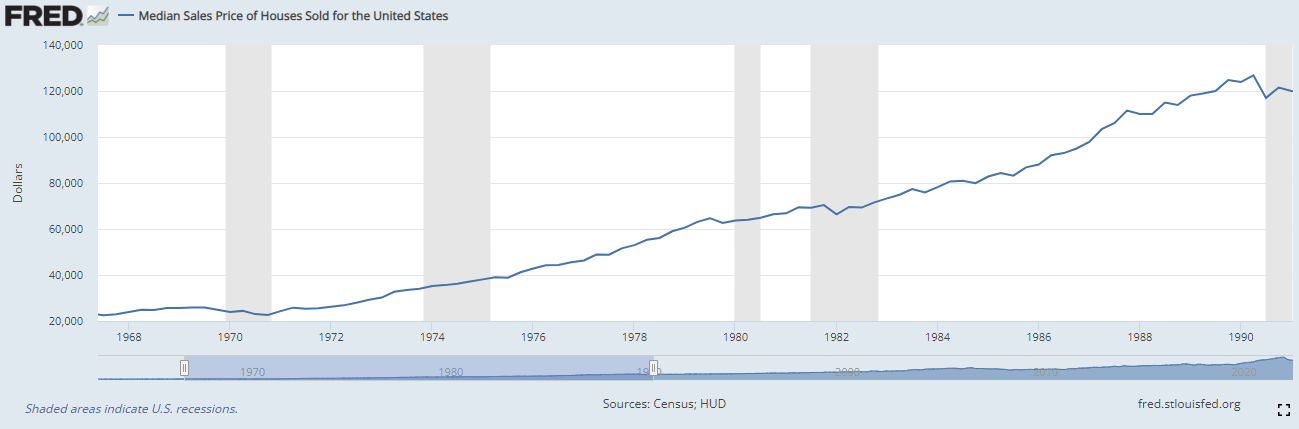

PS: I want to hammer on this point a little more for the broader audience. Real estate prices rise during inflationary periods as the cost of new supply increases due to inflation, and demand is also boosted on a nominal basis. Just look at home prices in the 70s and 1980s - homes appreciated at nearly a 10% annual rate in the 1970s. But - they declined about 13% in that initial recession in 1970!1 It is almost an axiom that real estate prices increase in times of higher inflation, as shelter is by far the largest component of the CPI at 34%. And its even bigger when looking at core at 43% - so mathematically it is very difficult to have high inflation without real estate playing a big part.

That is not to say interest rates and financing costs have no impact on price especially in the short run – they do, particularly when the increases are as rapid as we have seen in the last year. So I do expect some continued increases in private sector cap rates in the near term if the latest rate spike holds.

But at current prices I believe many REITs are really interesting opportunities (I know I’ve been saying this for several quarters now!), even assuming further private market declines in values.

I have no idea where interest rates will be 3 or even 5 years from now, but I feel very confident that quality CRE assets with good demand profiles will eventually revert towards replacement cost. Either the fed wins & rates go down, or we settle into a new higher for longer world, in which case we are going to see stronger CRE income growth relative to pre-Covid averages in order to rationalize new construction with higher cap rates.2

One final thing I want to note before the sector specific commentary. We are continuing to see a fairly wide dispersion of outcomes across various metros areas. This started during Covid & is historically pretty normal, but given the lockstep performance of many markets during and after the GFC it is something that many investors seem to have forgotten. As a real rough indicator, here is a housing chart from industry expert John Burns on the relative change in home prices across several metros. The for sale housing market has frankly held up better than I would have expected given where rates are – this may be thanks in part to the strong demographic tailwinds from the aging millennial generation.

Enough macro, onward to the sector specific commentary.

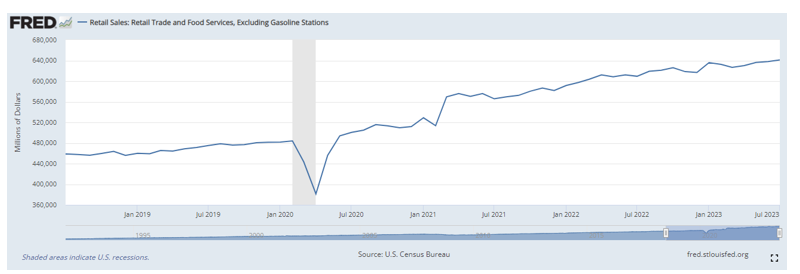

Retail: Retail fundamentals have continued to hold up well, with consumer spending continuing to rise.

PS: Just this morning the September data came in at a whopping .6% MoM, and August was revised up .1%. This is quite strong and I wonder if this may be revised down in future months. Regardless, a good sign for retail.

There is a lot of discussion over how much ‘excess savings’ the consumer may or may not have left (many economists just revised their estimates up significantly based on updated govt data), but the reality is M2 money supply, while down from peaks last summer is still up 35% or over $5 trillion from pre-covid levels. That is a lot of money still available to be spent, and retail spending continues to appear to be a beneficiary from this fact.

Retail leasing has also continued to be quite strong. Macerich, one of my favorites, has year to date had better leasing than 2022, which was itself their strongest year since before the financial crisis. And things have not slowed down, at least thus far. Here is MAC’s SVP of leasing commenting on leasing trends at a conference last month.

This strong leasing provides a solid income growth runway over the next several years. Combined with an attractive going in valuation (MAC is getting close to a 9% cap rate as of this writing) & close to zero new supply, well what’s not to like?

It’s not all roses in the retail world of course. The demand, while broad, still seems to be passing by the lowest quality centers, which are often assets in oversupplied submarkets. Further theft has emerged as a hot button issue in a couple of cities & submarkets. Target for example is closing 9 stores supposedly due to theft, primarily in San Francisco, Portland & Seattle. Overall as of now the impact of this appears to be relatively limited, but it bears watching should this issue spread to other locations. On the bankruptcy front – closures remain at very low levels, & the Party City bankruptcy resolved relatively positively with most stores remaining open.

PS: I neglected to mention the looming Rite Aid bankruptcy here which just occurred on the 16th. This has been on the watch list for awhile now and well here we are - the BK is somewhat idiosyncratic due to opioid lawsuit related expenses, but nonetheless is a negative for the retail sector. As of now their re-org plan calls for closing ~20-25% of their store base. Pharmacies are typically free standing and owned by triple net investors - the impact to the retail REITs should be fairly small, although some of the net lease REITs may have more exposure.

Still, it feels as if retail fundamentals have finally moved on from the ‘retail apocalypse’ we lived through for the last 5+ years (and one could even argue since 2007), but the market is not giving any credit to this turn around. I suspect there is some built up scarring here & a now entrenched negative perception of physical retail among investors. In fairness, 15 years of poor returns is a very long time!

So it may well take a few years of solid performance before the market comes around, but lucky for us most investor’s memories are also quite short.

Hospitality: The hospitality sector is in my view one of the more interesting, and I intend to do a deep dive article on it in the next few weeks, so will keep my commentary here relatively short. Valuations remain quite cheap, with hotels providing some of the highest yields in CRE, if not the highest. The main story on the operating side continues to be the same which is to say leisure has softened, but is still up a good deal over 2019 numbers, and a continued slow recovery in business and group travel. The hotel sector should also benefit over the next several years from very limited supply growth during covid and likely for the next few years. Here is the CEO of Hilton commenting on overall supply.

This is why hotels are so interesting – the market is pricing the sector like it’s a bond, plus what appears to be some residual covid scarring. And yet the supply / demand fundamentals are quite good, and assets are trading for way below replacement costs. Again we may have a near term hiccup if a recession ever does materialize, but the medium term outlook is really favorable.

Office: I have written extensively on the office sector on my Substack, so I would point you towards that for my latest commentary. The most recent article on WFH can be found here. Generally though office REITs have rallied quite a bit since their lows in the spring (really I should say the NYC office REITs have rallied a lot, many others have given back their gains), and have now shifted from very cheap to just cheap. These gains have helped power some of our performance relative to the broader REIT indices.

So the office sector, while still interesting, on a relative basis is now broadly similar to some of my other favorite investments. Leasing remains weak, although there are some small signs of potential recovery, at least in certain markets. I believe the dispersion of office returns across metros has the potential to be very large this cycle, so picking the right metros to be in is critical.

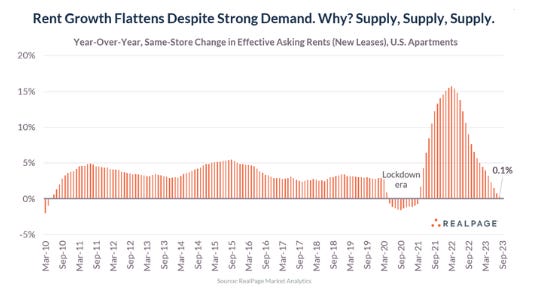

Multi: The fund’s lack of multifamily exposure has proven a boon this quarter, as many multi REITs are down 10-15%. This appears to be due to a combination of continued increases in rates, and a softening of the rental market. This softening is in turn driven by near record high supply deliveries (on an absolute basis, on a relative basis we aren’t even close to the 1970s). See below for two charts from Realpage’s Jay Parsons (also worth a Twitter follow!).

Nationally rental growth was basically flat in September. But things are quite varied from market to market, and many covid era darlings which saw huge increases in construction starts are now seeing some pretty hefty rate cuts due to significant new supply.

As you can see from the above, the declines are fairly concentrated in the sunbelt markets. This had led to a relatively greater sell off in the sunbelt focused REITs, at least as compared to the coastal ones. As of this writing some of the sunbelt REITs are getting pretty cheap – for example MAA, a sunbelt B asset focused REIT, is trading at over a 6.5% cap rate. That compares to private market sales still in the mid 5s (although that may go a bit higher if recent rate hikes hold).

If you may recall, I wrote about this coastal vs sunbelt dynamic back in Q3 of 2022. In that letter I wrote

“I believe the coastal markets will be relative outperformers as workers return from remote work and the new supply delivers into the sunbelt alongside slackening overall demand. This supply wave combined with a potential downturn is I believe a fairly large risk in many sunbelt markets that many private market investors are not fully appreciating.”

Well, here we are a year later, and what a difference a year makes! No downturn has shown up (yet), but the supply & higher interest rates has been enough to do some real damage to the sunbelt multi markets. Of course no private operator will admit this. For example BREIT (which is ~55% rental housing, mostly Sunbelt) is claiming their NAV/share is only down ~1% since October of last year, which is frankly comical given the 22 values appear to be based on ~4% multifamily cap rates.

Of course some investors have picked up on this fact, and BREIT’s redemptions remain elevated with requests still capped.

Industrial: The story in the industrial market is relatively unchanged from Q2. It continues to have the strongest fundamentals across CRE, and public & private values remain pretty strong. Values however are down a bit, with bellwether Prologis down ~10% (with an implied cap rate now in the mid to upper 4s). Private market is harder to say given fewer transactions, but it looks like cap rates have continued to creep up a bit, and may have further to go given the recent spike in interest rates. The often very wide gap between in place rents and market rents make industrial cap rates slightly tricky, as a deal with well below market rents is going to trade for a much lower cap rate than a brand new building with market rental rates.

Vacancy rates have continued to tick up slightly, especially in markets more exposed to new supply, which should slow the rate of rental growth going forward. 7-8% rental growth is simply not sustainable over a long period of time. That said many of the REITs still have very large rent marks to market in their portfolios, which should sustain strong NOI growth for several more years barring a collapse in market rental rates.

On the flip side new construction starts have continued to fall, and this may provide some positive support to the market in 2024 as new deliveries slow a good deal. Per Costar starts have fallen from ~140-150mm / quarter in 2021 and 2022 down to only 40mm this last quarter. If demand stays strong we may see some softness in market rates until mid 2024 and then rental rate growth could reaccelerate due to more limited new supply. Demand as ever remains difficult to forecast though – it remains quite elevated relative to pre-covid and this leaves me wondering if the overall sector is at risk of a substantial pullback if we have a recession.

Storage: Storage REITs have really pulled back from Q1/Q2, and are back to late 22 prices. Cube for example is down 18% over the last 6 months.

Given NOI growth this has put the major REITs around a mid 6s implied cap rate (tertiary market focused NSA is higher). The decline appears driven not only by the increase in rates, but also softening fundamentals. Storage market fundamentals have taken a turn for the worse, with occupancy down ~200 bps YoY. The REITs have had good NOI growth still due to strong continued rent growth, but this is being driven in large part by rate increases on existing customers. Market rents have actually declined ~10% YoY in many markets. Given the relatively short half life of a storage customer (about 12 months), this means revenue growth in the next 12 months should be fairly anemic, as should NOI (if not even outright negative).

The pullback appears to be a mix of supply and demand, with continued robust deliveries running into what looks like a potential covid bullwhip effect wearing off. The strong performance in 21/22 may have been driven by temporary covid moves (eg someone left their apartment in NYC in 2020 or 21, put their stuff in storage, and returned to the housing market in late 22), which are mostly unwound by now.

The absolute yields are starting to get interesting here, but the relatively lower leverage of the few REITs in the sector limits upside to some degree.

Fin

The story in CRE continues to be the interplay between fundamental performance (pretty good for some asset classes, weak for others), and interest rates. Higher rates are hitting everything, but I would expect the higher yielding sectors should see less impact – especially those which are also performing fairly well. Again I don’t know what the future holds in terms of rates and inflation levels, but a core appeal of high quality real estate is its long term inflation resistance. Long term, quality assets revert towards replacement values. And in today’s market there is a lot of opportunity to acquire great assets for well below replacement costs.

The run up to this recession saw a relative financing cost increase that brought the 10 year from ~5.5% to nearly 8%, a much smaller percentage increase than we saw in this round of hiking, but closer on a nominal basis. Obviously demand loss during the recession played a part too, but this transition point from a lower rate world (1930s to mid 1960s) to a higher rate world is somewhat analogous to today’s environment I think. That is to say if higher rates were to stick of course.

Note I said CRE here and not all RE. Residential prices have not seen the big fall that CRE prices have, and are much closer to replacement cost in most markets. This can easily be seen in the fact that homebuilders continue to build new product - so the single family market does not stand to benefit from this supply side tailwind.