Here we are, another year older and hopefully wiser. I wanted to share thoughts on the current state of affairs as well as reflections on the prior year & some thoughts on moving forward in 2025. As per usual I intend do a CRE sector specific write up later once all the year end results are in.

As always, this is not investing advice and please read the general disclaimer, here.

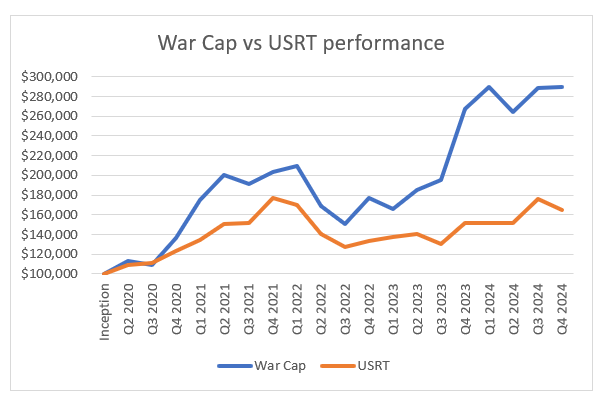

First, the returns. We had a solid year - we returned 8.48%, vs 7.60% for our real estate benchmark, leaping from underperformance most of the year back to outperforming on a strong (relative) Q4. When compared to the S&P’s high return of over 25%, it doesn’t feel quite as good, but we did significantly outperform the S&P the past two years, and you can’t win every single year.

Since inception we are still handily outperforming the REIT index, and also the S&P, with returns of 189.92% (about 25.5% annualized), vs 64.93% for the USRT index (about 11.3% annualized) & 121.20% for the S&P (about 18.5% annualized).

I feel especially good about the fact we are beating the S&P since inception considering that we have zero exposure to the mag 7, which is what is driving essentially all the returns in that index (and big tech in general really).

To illustrate here is an interesting chart from the FT showing the increasing concentration in the S&P.

FT article link here

Of the top 10 stocks, all but 1, Berkshire Hathaway, are tech related. Now in fairness, big tech has had a magnificent run of generating increasing profits and cash flows, so to some degree it is natural we have this level of concentration. The risk in my view is that if the growth slows or stops, we come crashing back down to reality as the market is increasingly tied to the fortunes of a handful of firms.

And what is driving big tech’s growth? Well over the last decade it was ‘software eating the world’ as Marc Andreesen famously predicted. However past is not necessarily predictive of future, and things look a bit different looking forward vs back.

Now - I’m not a big tech expert, but I do feel obligated to stay somewhat on top of the goings on there simply due to the aforementioned massive economic concentration (and CRE generally gains on population growth and income growth, big tech being a huge driver of the latter).

As I’m sure you are already aware, AI has been and continues to be all over the news, specifically the subset called generative AI, powered by large language models or LLMs mostly. The recent advances in this field have unleashed an investment boom of historic proportions, largely in the data center and semi-conductors world.1

How big is it? Well it looks like based on estimates from economist Skanda Amarnath (full article viewable here on Bloomberg), we are getting close to 2000 levels for telecom & data centers.

This is especially relevant, because the capex spend relating to AI on data centers, chips and training / inference time seems to have dramatically outstripped actual AI end user spending.

I had trouble finding good estimates for either of these things, but it looks like there is at least ~$200-220 billion in direct AI related chips and data center spending, if not more (Nvidia and Broadcom’s AI products are ~$150b alone).2

However the end user spending on AI services is much smaller, albeit growing quickly. How much smaller? Well again this is very difficult to find as many firms do not disclose the specifics, but it looks like total spend in 2024 could easily be under $15 billion.

Menlo Equities, a reputable VC firm, seems to estimate enterprise end use spending (so not the capex models / training / servers part) at $4.6 billion for 2024, but up significantly from 2023.

On the consumer side - Open AI apparently has a run rate around $5b. If we generously assume there is another $6b of consumer and unaccounted for enterprise spend, we get to maybe $16b of revenues, against capex of probably $220 billion.

Even at a generous 30% profit margin (which is absurd as Open AI lost $5 billion to generate their ~$5 billion in revenues), that’s $5.3b of actual return on $220b of spend, an awful ROI of just ~2.5%! When you further consider much of this stuff has a very short useful life, the ROI looks even worse.

The only way this makes sense is if end use for AI continues to grow at a massive pace for many years. So the next question would be, how much end user spending would we need to justify the capex wave? Well given the useful life of much of this capex (at least the chip part), is a measly ~5 years3, this means you’d likely want a ~30% return on the spend. If we assume some things like data center power/cooling are longer lived and we use 10 years of average useful life, we could conservatively look for a 20% return. That would be ~$44 billion, or nearly 3x the total current industry revenues! But again revenue is not profit, so again using an extremely generous 30% margin, that is ~$145 billion in needed revenues, or ~10x current levels. At a 20% margin its $220 billion, and 10% its $440!4

And this is to say nothing of potential improvements in AI model efficiency, which is very relevant as Chinese firm Deepseek recently released a GPT4 analog model in December and an o1 reasoning type model just the other week. Deepseek’s model is open source, and it appears to be massively more efficient than the leading American models, seemingly due in no small part due to the chip constraints Deepseek had to operate under. Estimates vary but the simplest comparison to me is their price per 1mm tokens (tokens represent model output essentially) - Deepseek is almost 30x cheaper in this regard!

This is a seismic shift in pricing if it holds. To match that kind of pricing would knock down industry revenues from ~$15B to ~$0.5B! Sure utilization will increase with lower prices, but honestly I don’t think pricing is a huge holdup right now for many users. Most of ChatGPT’s revenue appears to come from its basic $20/mo subscription - this isn’t exactly terribly expensive. If you drop that to just a dollar a month I’m sure they would get more users, but I don’t think it would be 20x. 2-4x seems more realistic at best case. So conceivably the industry revenue could drop to something like $1-2 billion in a worst case scenario - I don’t think this is likely but it illustrates the scale of the problem.

Will AI end user spending grow in 2025? Very likely yes.56 Will it continue strong growth thereafter? I would also bet yes. But will there be a sufficient return to justify the current massive capital spending? It seems very unlikely to me, especially now with Deepseek’s massively lower pricing.7 What feels more and more likely is a cousin of what happened in 2000 - hype and mania lead to overspending on capital, creating poor returns for the investors but dramatically reducing cost of the physical side of things, allowing innovation to continue at a nice clip. The billion dollar question is, is this 1999 or 1996 as relates to AI capex spend?

As I wrote this piece originally I was leaning more 1996, however the release was delayed awhile because I got sick. During that time we had OpenAI announce its teaming up with renowned capital incinerator, Softbank (and Oracle) on a supposed $500 billion dollar project. This is just silly, Softbank does not have nearly enough capital to fund even a portion of this, nor does OpenAI. Further Softbank is apparently in talks to invest in OpenAI at a reported ~$340 billion valuation, 2x their last value from just October! So yeah now I’m feeling more like its 1999.

It is obviously extremely difficult to predict something like this, and my view here is not strongly held. I do believe tech is the most important non political swing macro-economic driver though and as such bears close watching.

Ex tech, the forward momentum of the economy was looking fairly shaky for much of 2024, but has improved steadily over the last few months. As I mentioned previously, the Sahm rule (relating to increase in unemployment rate) was breached, and unemployment shot up pretty quickly earlier in the year. Thankfully it has since come down, and with the last jobs data we got on the 10th the recent trend is looking like perhaps it has stabilized.

Interest Rates & Valuations

Moving on to the other big piece of the puzzle, valuations and the cost of funds. On that front, the market had felt fairly to highly valued to me, but with the recent selloff some things are beginning to look more interesting. REITs in particular feel more fairly valued than over-valued, but with notable exceptions in both directions.

The biggest story, at least as relates to CRE, is probably the recent spike in interest rates.

The 10 year is up about 90 bps from its low in the fall, down slightly from over 100 a few weeks ago. This is obviously bad for financing costs, and all the myriad industries dependent on it (most notably real estate, but really anything hard asset driven). It also is not great for generic valuations across any investment asset, as the risk free return is higher.8

What is driving the increase? It doesn’t appear to be inflation, at least to me. Inflation had ticked back up in the fall, but came down significantly in the December and January data.

Source: Jason Furman on Twitter, give him a follow @Jasonfurman

Unlike last year, treasuries don’t seem to be moving much on inflation releases anymore (eg a year ago when inflation was the big narrative we would have seen a big drop in rates from the recent very low PCE inflation release). We saw a bit of easing with the PCI and CPI, but not as dramatic as last year’s moves.

My best guess is the market is pricing in higher inflation & supply disruptions due to potential Trump tariffs and also continued large fiscal deficit spending by the US govt (and indeed all western governments). This is also showing up in an increase in government bond yields across the west.9 This combination of fiscal deficits and supply disruption is a potent, potentially stagflationary brew. Thus, the return of the bond vigilante.

There is much talk of cost cutting with the new DOGE commission, but unfortunately the only way to really decrease government spending in a meaningful way is entitlement reform or to reduce military spending - non defense non entitlement spending is something like only 15% of federal spending I believe. And it doesn’t seem like anyone is ready to have that conversation yet, so continued large deficits seem very likely unfortunately.

As always though predicting the future is very difficult, and I do not have a high degree of confidence for how 2025 will shake out. Trump is already moving to impose high tariffs on Mexico, Canada and China - if the tariffs remain at current levels they could prove quite disruptive and create a huge drag on economic growth. At current levels the tariffs would be ~1% of GDP, which doesn’t account for the likely retaliatory tariffs we will see in response. The tariffs look very bad, but Trump has already within just a few days seemingly reversed course on the Mexican tariffs and promised to delay them for a month. The whole situation frankly is just pure chaos.10

I believe this means that the general economic growth/demand path has a pretty wide potential variance in outcomes, which calls for caution. Tech capex could continue to be a strong driver, or it could begin to unwind11. Small business optimism is up significantly, which could be a potent tailwind. Tariffs could range from relatively benign to disastrous. Given relatively high market valuations this is not an attractive combination.

Reflections on 2024

In keeping with tradition, I also try to look back at the prior year and reflect on what went well or poorly in my investments. We outperformed the REIT index which is nice, but were well below the S&P. I can’t control the S&P, so really all I can do is look at my own investments and what dragged my performance down. And the main drags on my portfolio were as follows.

First, the largest drag. I have a few small cap investments which declined despite the overall rise in CRE pricing & REITs. Generally speaking I still feel decent on these, although one which is quite small and lacks a specific catalyst I am feeling less good about. The other, ILPT, has a potential catalyst in the form of loans coming due in 2 years, which should force some kind of action that will hopefully de-lever the firm (or even trigger a sale). Although it is entirely possible they are able to refi the portfolio as is and just continue to scrape by while sweeping all free cash flow into management fees (the worst case scenario).

I think my biggest mistake here was investing as much in these while other larger, more mainstream investments were also quite cheap. I did this somewhat in the name of diversification, least I become too concentrated in a few stocks.

I think though given my high confidence levels in the more mainstream bets (VNO , MAC etc), in hindsight I should have put less in the small caps and even more in those, diversification be damned12. And then I could have saved the small hairy investments for later in the cycle (or not at all).

The other drag was weakness in Park Hotels & hospitality in general. There were some operational hiccups here (notably a strike in Hawaii, but also a general leisure slowdown), but generally I still feel confident in this investment and think it is quite cheap at current prices. Cash flow is strong and should grow moving forward. So I don’t think I really made any mistakes here… at least not yet.

Looking Forward

Looking into 2025 I still feel like the uncertain macro picture, combined with higher valuations, doesn’t feel like the best risk reward combination, but it is better than it was a few months ago.

Probably the biggest change for 2025 is I intend to look at some non real estate investments. I originally made some non RE investments back in 2022 when real estate prices were high and there were several non RE firms I thought were very attractive.

I decided to close these out in the hopes of presenting a cleaner real estate only focus that I was told would make a better story for institutional investors. Well, I was not able to raise any institutional capital, and selling these investments in fact dragged my returns down.13 My biggest of these was Spotify, which operationally worked out essentially exactly as I thought it would.

So sad to have sold in 2022

Not every non CRE investment I made worked out well, but most did, several in a big way. A&F was another. The biggest loser has been Sportsman’s Warehouse - I still own a bit personally, and it has been painful.

I have decided that doing something for the sake of optics for a prospective LP is foolish given the difficulty in raising institutional LP capital anyways. So the goal now is to find the most attractive investments, where ever they may be. That said, real estate will remain a major focus as I know it best, and the caliber of competition there is pretty low.14 In fact I have spent much of the new year working on a CRE investment which has quickly become my largest position - I hope to do a detailed dive on this soon if time allows.

My approach to non real estate investments is ultimately similar to real estate. What is the current yield the investment can generate, and what are its growth prospects? 15 Then how does this compare to other options, as well as what are the downside risks. The key difference is obviously understanding the operational & demand nuances of different industries, and so here I generally try to stick to things I understand well, or am able to learn relatively quickly. This covers software firms16, consumer goods or retail that I actually consume (or have good knowledge of), and asset heavy businesses among others.

I firmly believe that being a good investor is a general skill, and that it can be transferred across domains with sufficient base knowledge.

Fin

As always, thank you for reading. I am hopeful I will be able to continue generating strong returns for my investors in 2025 and beyond.

Although AI VC funding is also pretty hot.

I would also include the model training costs in capex as well, which while large don’t seem close to the chip spending itself.

And the model training spending is even worse, as they seem to become obsolete in a year or two after release.

I suspect end margins are lower, more in the 10-20% range, given that unlike traditional software LLMs have a marginal cost for each use, and traditional software margins seem to top out around 30% (with exceptions of course).

Unfortunately also it looks like the capex side is also set to dramatically increase in 2025, so it isn’t even clear if end use spending will begin to catch up much!

I suspect Deepseek isn’t able to perfectly take market share due to some firm’s hesitance to use Chinese software & switching inertia. However people are already working on getting versions up and running on US servers - this is the beauty of open source.

I think eventually revenues could hit those levels - in many years. Unfortunately those future returns would be to the benefit of future capex spending - the current spend seems almost certainly underwater. In investing getting the big trend right is the (relatively) easy part - its the timing that is hard!

Although as I have argued before, this is typically a short run impact and medium to long term quality hard assets or firms with pricing power should be an inflation hedge. The real issue is if rates rise without commensurately higher GDP growth, the much feared stagflation scenario. I don’t think fiscal deficits would be stagflationary by themselves (that is just pure vanilla inflation), but I do think high tariffs could be as they would effectively destroy/distort supply. A trade war is really a truly nasty economic risk as it just generates pure deadweight loss all around.

Interestingly China’s have fallen off a cliff recently, and are basically at all time lows.

I am becoming more worried large tariffs will stick around in some fashion. Trump really seems to be a mercantilist or even an autarkist… he has written and spoken extensively on his dislike of trade deficits & love of tariffs, and at this point I’m inclined to take him at his word. This subject could warrant its own article but I really do worry a trade war could have significant negative economic consequences.

At this point I am confident it will unwind, the question is just how soon. I’d guess 2026 at the latest, but it may happen this year.

The older I get the more I think diversification is a false god, if you have really quality highly compelling potential investments (which are not common). In which case just load up on the good stuff. But in a more unclear, richly valued environment I think diversification has more value, and I certainly think for the average investor diversification is very good because they simply lack the ability to properly evaluate when something truly is a phenomenal opportunity worth of heavy concentration.

Assuming I held to today’s pricing, which of course is hard to truly evaluate in retrospect.

Although the more I read from major hedge funds & tech investors the more it feels like the caliber of even large investors is just very low throughout the investing world.

As most are aware, the significantly higher potential growth rate in other industries requires a bit of a different mindset from value investing. But ultimately I do believe being a good real estate investor requires a lot of focus and attention on the growth rate there as well - things are a bit more transferable than they may seem from the outside looking in.

I actually know how to code and toyed around with building a CRE software startup years ago. I was for awhile hesitant here assuming a greater level of competence across the tech investment world but the more VCs I have met the more I realized that many people in tech are in fact very non technical, with pretty poor understanding of some of their own fundamentals. A lot of the tech investment world appears to have just been people in the right place at the right time, which really shouldn’t be so surprising given the astronomical returns some firms have generated for early investors. Was every early Google or Meta investor a genius? A few probably were, but most were likely just average people who happened to have some personal connection to the founders and enough money at the time to invest.

That was a great letter! Thanks for posting and also best of luck for the new year.

Hello!

Thanks for the update!

Is it possible to see your current portfolio?