Although it may not look it from my posts here, I invest in a lot of other things other than office REITs. So in order to mix things up I have decided to write a bit about the hotel space, another area I find interesting.

The Four Seasons Jackson Hole - owned by Host. If nothing else hotels are certainly the most fun asset class, where else can you write off a visit to a ski resort as part of due diligence.

First - again let me point you to my general disclaimer page here. Nothing here is investing advice, do your own DD.

Hotels in general are cheap in the public markets - most hotel REITs are trading in a 8-10+% cap rate range. This is one of the highest commercial real estate yields available outside of the office sector, and even then it’s often comparable.

But this yield is superior to that offered by offices in several ways. First and obviously, hotels are not facing an existential crisis like WFH. Second - the capex burden of hotels is generally superior to that of office.1

For comparison multifamily, industrial, & self storage cap rates are in the mid to low 5s (although after the recent treasury spike those may be headed higher).2

So why are hotel yields so much higher - is there something specific to the asset class, or some looming trouble on the horizon?

As it relates to the asset class the short answers for potential discounts are covid, capex, operational intensity and volatility - I’ll spend a bit on each below. Spoiler alert: some discount is warranted here but nowhere near what the public markets are pricing in.

As for whether there might there be some looming issue on the horizon which could cause incomes to decline - the short answer is no. To fully address this though I will dive into the state of the hotel market & its primary sub segments of leisure, group & business transient travel. The big story in hotels since covid has been a strong recovery in leisure/resort that has now moderated some, and a slower ongoing recovery in urban business/group hotels. The urban markets in particular I believe present interesting opportunities, as if trends continue to normalize growth in these markets could push strong yields even higher.

Some Background

Before we get too far into the details, it is probably worth spending a moment on some general industry terminology/background, and what I believe is a failing in the public markets. My big beef is that everyone in the public space, including the REITs, uses Ebitda to refer to hotel earnings. However the private sector, which is most of the hotel business, uses Net Operating Income (NOI), same as other real estate asset classes. I really dislike the use of Ebitda in publics because it is not how hotels are actually valued, and because you cannot convert it cleanly / easily to NOI.

The reason for this is that hotel NOI is essentially Ebitda less capex reserves plus corporate G&A. Hotels are a capital intensive business - beyond the building itself, room soft goods (beds, sheets, furniture, carpet, often referred to as FF&E), experience intense wear and tear and need to be replaced frequently. Over time the industry has acclimated to this and uses an industry standard 4% of revenue as an FF&E / upkeep reserve. This is not something owners just opt in to - the brands themselves (Hilton, Marriott etc), typically mandate FF&E spend in their franchise agreements.

This formula causes an issue with translating Ebitda to NOI, which is that a higher margin hotel is going to have a smaller ‘loss’ of NOI to Ebitda, while a lower margin hotel will have a much higher loss. See the below chart for a simple example of this.

This is then further obscured by G&A - as G&A does not scale linearly with size (Eg there are economies of scale), a larger REIT with a smaller relative G&A load will have a smaller difference between NOI and Ebitda, as compared to a smaller REIT with a higher relative G&A load.3

So by using Ebitda to compare hotels, public operators are using a less precise metric as not all hotel Ebitda is created equal! In fairness the effect isn’t massive, but it can easily be a 5% differential in effective NOI yield. Another benefit of NOI is it gets you closer to the actual net cash flows in this case.

It is also worth noting that margin does not necessarily scale with quality - a high end unionized hotel may have inferior margins to a lower end basic hotel. Basic full service hotels4, especially lower end ones, also often have poor margins relative to select service hotels. There is in fact an ongoing secular shift in the hotel space due to these margin differentials, where there is continued growth in brands which offer owners the best margins.

OK - back to our yield differential.

Residual trauma

First and foremost, I believe the answer is simply covid related scarring. We are not very far out from the most negative event in the history of the hotel asset class.

I don’t need to rehash it here as we all just lived through it, but it is easy to forget that almost all hotels had zero income 3 years ago, and many urban hotels still had no income in 2022. Hell San Francisco as an entire market still is essentially at zero income. So it shouldn’t be surprising this trauma has created some scarring.

This scarring is evidenced in buyer interest in hotels, but I think is even more visible in the financing markets. Lenders are inherently more conservative that buyers, and it shows it hotel financing. Financing is still difficult today - spreads on hotel lending have blown out since covid, and now hotel debt is 300-400 basis points over the relevant treasuries, vs more like ~200 over for other asset classes. The spread was much tighter pre-covid - for example Park Hotels had a blended interest rate of ~3.9% in Q3 2019, vs 3.6% for top multi REIT Avalon Bay.

Now for top borrowers like the hotel REITs the spread does appear to be coming back in relative to other asset classes - however not many are issuing debt right now given what is typically ample liquidity and the ugly rate environment.

This residual trauma I believe explains the lion’s share of the current REIT pricing. Luckily for us, this is something that should fade over time.

But some level of yield differential is warranted due to some hotel specific issues, as I shall explain.

Capital Expenditures & Cross Sector Yields

The second big issue with hotels is capex. I’m going to spend a bit of time on this as it is an important part of cross sector CRE comparisons.

Based on historical REIT data, the capex burden for hotels (above and beyond the 4% reserves which are already baked into NOI, more on that below) is generally in the 12 to 20% of NOI range. The reason I give a range is that the REITs, as do all operators, bucket capex into maintenance (things like replacing an elevator or the roof, or mandated soft goods updates), and development (most obviously building a new building, but really anything that has an expected ROI to it). The issue is the development bucket can be a bit fuzzy, and it’s possible to rationalize calling something development that is really more maintenance5. Without exact specifics we can’t say for sure - but if you assume there is zero accretion to development spend you get about ~20%. If you assume about 50% of development spend is accretive, that yields capex of ~12%.6 Assuming all development is accretive by the way and your capex burden falls to only another ~3-5%. If I had to guess I’d say the true capex burden is somewhere around ~15%, but it is important to note it varies based on operator and portfolio quality. And compared to multifamily, 15% actually isn’t that bad, its fairly comparable. However - capex has the potential to be significantly higher than 15%, in ways that are somewhat unique to hotels.7

Smaller operators, operators with weaker brands, or just plain bad operators, are going to be at the high end of that range or potentially much worse, as will older, lower quality portfolios. Remember capex also scales inversely with land value - assets with high land value have a relatively smaller capex burden relative to income. So this 15% is for REIT land - a portfolio of old hotels in lower tier markets is going to be way higher.

The other reason capex can go much higher is something called a PIP.

Industry Structure

A quick aside on industry structure.

Part of this capex range derives from the current structure of the hotel industry, whereby the brands (Hilton, Marriott, etc) are separate from the actual ownership of the hotel via a franchise model.

This model means the brands and owners have different incentive structures. In particular brands are motivated to keep their fleet of hotels in top condition - they reap all the financial benefits (higher revenue driven fees), and basically none of the costs. Brands also can have a lot of leverage with owners, as the top brands can bring significant outperformance compared to a weaker brand. Not only can they drive more traffic due to brand awareness & loyalty programs, but the brands can also offer lower costs from third party hotel booking sites as they have the scale to negotiate lower commissions.

These differing incentives manifest themselves in something called a Property Improvement Plan, or PIP. When a franchise agreement expires, brands will often essentially tell an operator they must implement a PIP, or risk losing their franchise.

As you can probably guess - the largest operators (like the REITs) are going to have a lot more negotiating power to reduce these capex impositions than a small operator. This may sound like I’m getting into the weeds here, but this dynamic & PIPs are a really important part of hotel investing. A big PIP or loss of a flag are often behind some of the biggest hotel loan losses, and is a big reason why hotels are perceived as a high capex asset class.

OK back to our comparisons.

We’ll use 15% for our purposes here in looking at the REITs.8 At a 15% capex burden, that means a hotel REIT trading at a 10% cap rate is effectively yielding an 8.5% unlevered net cash flow.

That is just huge compared to the rest of the CRE world. For comparison, class A multifamily is in the ~5-5.5% cap rate range with a ~15% capex burden (again lower in high value markets, higher in cheaper ones in general).9 So a 5.25% cap rate multi deal would yield around ~4.46% of net cash flow. That is literally nearly half of the yield on hotel REITs! The other popular kids (industrial and storage), are in a similar range of NCF yields. I should note that I suspect the recent spike in treasury yields may be driving these cap rates a bit higher but the same idea is true regardless.

Operational Intensity & Volatility

Now - hotels and multi are not equal. Hotel income is more volatile, especially in downturns, and therefore warrants some level of yield premium. To not get too sidetracked here a simple way to think about this is once every 10 years you have a recession and make no money that year, or about a 10% drag on earnings over the long run.10 Setting aside the fact that other asset classes also have earnings declines in downturns (not to mention ongoing generational high supply waves), that would turn our 8.5% cash yield into a ~7.65% yield. This is still way way higher than the popular asset classes.

The last piece we need to address here is the operational intensity of hotels. Hotels have a much larger operating component than the other major real estate sectors, and by and large I believe this warrants some additional level of yield premium. This is because the operational intensity effectively adds an additional layer of volatility, albeit one that is controllable with skill. That is to say - an LP in the hotel space has a much larger risk of a given investment blowing up on them because of a bad operator than an LP in other asset classes. It’s pretty hard to mess up a warehouse, but you can really run a hotel off the rails if you don’t know what you are doing.

The other part of operational intensity is the need for a bunch of employees. This in turn means unions in certain markets, which is another layer of risk and complexity. A union hotel is at risk of the union being able to negotiate pay increases over the rate of CPI, which long term can erode NOI margins. Now this risk doesn’t apply to every hotel, but its a fairly big chunk of the REIT universe.

This last piece is fairly hard to quantify as its pretty subjective & also variable. A good operator with minimal union exposure or a good union position has basically no drag from this, but these two items can be significant for a bad operator.

What is this worth? I would estimate another ~50 basis points of return long term. This would bring out 7.65% yield to ~7.15%.

So - the hotel sector is significantly cheaper than other CRE asset classes. To normalize returns with multi you’d need cap rates in the mid to high 6s on average.11 Perhaps not coincidentally, this is pretty close to where many hotel REITs were trading in 2019.

The next question is, is this discount warranted for some reason, could there be a really awful outlook for hotel earnings over the next few years for example? Or is it just a result of the scarring investors experienced during covid as I theorize above, something which will likely fade over time. To answer this we need to dig into the state of the hotel market today.

Hotel Industry State of Play

As is obvious to everyone, the hotel market was hit really hard by Covid, and has been in a state of recovery for the last few years.

One of the most important things to understand about the recovery is its uneven nature, where we saw domestic resort & leisure hotels recover much more quickly than urban and group / business oriented hotels12. Leisure oriented hotels have done so well that most of them eclipsed 2019 numbers last year, and remain 10-20% (or even higher) over 2019 earnings, driven in large part by higher prices.

The typically more urban non leisure hotels have been much slower to recover, and are only now starting to scrape into parity with 2019 performance. This obviously varies significantly by market - SF for example is still way below, whereas some more growth sunbelt markets are running close to or even above 2019 figures. NYC notably has rapidly improved and is over 2019 levels thanks to a strong travel market, a local Airbnb ban, & city rentals of rooms for migrants. Many of the other major markets though, such as Boston, Chicago etc are still below 2019 levels. It may not feel that way to the consumer though because rates are higher, but occupancy is lower.

This urban underperformance is interesting and I believe is the source of potential investment opportunity, as an investor can acquire significant urban exposure at a fairly attractive yield. If urban performance normalizes with pre-covid, or even comes close, it could generate significant additional earnings tailwinds & bring an already high yield even higher.

To really understand the market though, we need to dive deeper into each of the major customer segments.

Customer Segments

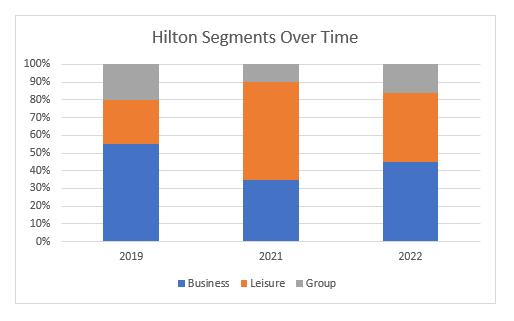

Pre-covid the mix of hotel customers was about ~55% business, 25% leisure, and 20% group, as you can see in the chart for Hilton below.

The chart only goes to 2022 because I can’t find exact figures for Hilton in 2023 (the segment mix isn’t a regular disclosure item and is addressed intermittently in earnings calls).13

As these are just share figures they don’t show total change in category size, but what happened basically was (domestic) leisure travel increased, while business and group shrank dramatically. These trends have begun to reverse as can be seen in the 2022 figures, and what happens to the various segments is an absolutely critical question for the overall hotel market.

Generally thus far in 2023 the story has been one of slight declines in domestic leisure travel, with continued strong recovery in business and group travel, especially in more urban markets.

This can be seen in disclosures from the big hotel operators Marriott & Hilton. Here is Marriott’s commentary from Q3 earnings, where they noted that group is back to pre-covid levels.

coded = covid, these transcripts occasionally have errors.

Hilton didn’t disclose exact group share in Q3 but it also noted group & business led its YoY growth.

Now these overall trends have not impacted all individual hotels equally. Many hotels, by virtue of their location (and branding), are focused on a particular segment. A beachfront resort is obviously highly focused on leisure travel (it’s important to note this can also include some group like weddings). A CBD hotel is often very focused on business travelers, same with a suburban hotel in an office park. Group is a little less easy to spot offhand, but is also a subject of specialization. While every full service hotel attempts to compete for group business, some hotels are specially focused on it. These are typically hotels with large numbers of rooms, large amounts of meeting & banquet space, & also often group travel friendly locations (convention center adjacency being a huge driver here).

The variation between segments here is more easily seen at the REIT level, where some leisure hotels (especially resort type beach hotels), are down as much as 10% or more YoY in revpar (revenue per available room), and certain business or group focused hotels are still underperforming pre-covid levels.

Leisure

While year over year leisure decline is not good for hotel owners, 2022 was a record year & leisure revpar levels are still higher than 2019. Again using Hilton as an example - US leisure revpar is up 10% from 2019 .

So overall leisure demand has held up pretty well even as the world has normalized. Rates are often much higher than pre-covid levels, and they look set to stay that way (albeit with some declines from peaks). To some degree this makes sense - we have had a huge bout of inflation, and so hotel rates reasonably ought to be a good bit more expensive than they were pre-covid… just as pretty much everything else is. That said the ultra luxury segment of the market still feels insane to me - look at the room rates for a hypothetical ski trip this January to Park City! I mean the apres at the St Regis is good but I don’t think it’s quite 3.5k / night good.

The other key component of leisure is international demand. This isn’t a huge share of demand in the US (it’s +- 10% of total demand for many of the large owners), but for certain markets it can be very important. The big thing to know here is that most international travel has come back pretty strong, but travel coming out of Asia is still well below pre-covid levels.

One of the main reasons for this is that China, by far the biggest demand source, literally had a ban on group tours overseas up until August of this year. Another big source of demand (again for certain markets) is Japan. Japan had pretty strict entry rules due to covid up until April 2023, and was all but closed to travel until the fall of 2022. As many overseas trips are planned a long ways in advance, it makes sense that it will take some time for tourism numbers to fully recover. Sure enough, in Q3 Park Hotels reported that Japanese share at its Hawaii resorts was finally rising, with a significant increase from 8% of pre-covid figures in the first half of the year to 24% in Q3.

The question is might there be any long term impacts on demand. On the Japan front I don’t see any reason to expect any long term decrease in visits to the US. China is a different story - there is some risk negative US sentiment could drive down visits to the US, however this could be offset by income growth which generally enables more travel.

Business travel

Next up is what was the largest customer segment pre covid, business travelers. I think during covid there was a real question of to what degree zoom and remote work might permanently reduce business travel demand. However at this point business travel was back to about 92% of pre-covid levels per Hilton’s Q2 earnings call,14 and continues to grind higher. In Q3 they didn’t disclose this exact figure but noted midweek revpar, a proxy for business travel was up 500 bps QoQ! I would guess that business travel is essentially back to pre-covid levels, or very close to it, based on the rise in midweek revenues for Hilton.

In particular Hilton notes that small and mediums businesses are in fact traveling more than they were before covid, it is just some large corporate tech and financial accounts that are traveling less. I suspect given the tech recession and the anemic market for new IPOs & debt that the large corporate travel lag is at this point cyclical & will pick up once those corporates stop cost cutting measures.

It seems reasonable to assume that business transient gets back to 100% (Hilton mgmt believes it will in 2024), if not quite all the way there. Marriott has a similar story - for Q 2 business revenues are up over 2019 driven by higher rates, but overall travel is still down slightly. Unfortunately Marriott gave no specifics on business in Q3 vs 2019.

Again unfortunately the brands often don’t break down the segment data in as much detail as I’d like (eg some of the stats above are global), so it helps to look at the results of large US REITs for more specifics.

Here is Host’s commentary from Q3 - they saw a much larger overall decline in business travel from covid, but continued steady improvement this year.

One thing to note here is that certain cities, notably San Francisco and to a lesser degree Seattle & LA, have had massive declines in travel, and SF happens to be Host’s largest market at about 10% of rooms, and that likely explains some of the relatively larger business decline Host has seen.

And here is Sunstone’s management commentary from Q2 (Q3 call is later today, the earnings release noted 7% YoY urban & convention revpar growth) - stronger rate growth than Host but the same general story.

As you can see at the REIT level there is significant divergence based on specific hotel and market performance - the reality is in the US market level performance has been highly variable (again SF being an absolute disaster).

Given the continued gains across the board, the impact of covid on business travel looks to be largely temporary. Zoom, it turns out, has not been able to replace in person interactions.

Group

The last segment, group travel, covers anything from a wedding or corporate retreat all the way up to a major convention or conference. Group travel was the hardest hit by covid, as essentially all major conventions and conferences were cancelled. And because these events are often planned a year in advance, the convention/conference calendar was still highly disrupted earlier this year (it’s easy to forget but in 2022 there were still a decent number of covid restrictions and worries). But finally in Q3 group looks to have finally just about completed its recovery.

Here is Hilton again - Group Revpar finally exceeded 2019 levels in Q3

Not only that, but 2024 is shaping up to be significantly stronger with 18% YoY group growth! Marriott has similar advanced bookings growth, with group 2024 booking pacing up 14% YoY.

Again it’s easy to forget, but for awhile there were real questions as to whether business & group travel might be permanently impaired by covid. Some pundits were predicting Zoom would reduce the number of in person meetings and gatherings. I never bought this story, and am happy to see my conviction vindicated in the continued growth in both business & group travel.

If anything I could see a world with more business / group travel given the likely continuation of some degree of remote work. I could see firm’s that have gone remote first increasing their demand for corporate retreats and other gatherings to bring far flung employees together.15

So - as we can see across the three major segments, there are no obvious large headwinds the industry is facing. Leisure has held up quite well, and group/business continue to recover in the US. Longer term - travel demand has grown in step with incomes & population. More wealth = more travel, & the same is true of more people. Considering the US continues to grow both population (albeit more slowly), and critically income, it is reasonable in the US to expect growth rates roughly in line with general economic growth going forward.

Setting aside general macro-economic concerns (which always exist), I don’t see anything ‘special’ about the fundamentals in hotel industry right now that ought to warrant a huge price discount. 16

Private Equity Comes a Knocking

I am not the only person to have noticed how cheap the hotel space is. A large take private deal was just announced at the end of August, wherein Hersha Hospitality is being sold to KSL Capital Partners, a large PE firm.

The headline stats on the deal are really positive. KSL is valuing Hersha at ~$1.4 billion. Based on their recent hotel level ebitda of ~$110mm & after taking out the 4% FF&E reserve we get an NOI of ~$96mm. That is a ~6.9% cap rate - again about where many REITs traded pre-covid.

Now - Hersha’s portfolio is very concentrated in core coastal markets, with Manhattan and metro NYC being about a third of earnings, following by Boston & So FL combining for another ~30%. They have a decent mix of urban vs resort, but do skew a bit urban. Also of note is the portfolio is only about 60% encumbered by management agreements (unencumbered deals typically trade for a bit more as you aren’t locked into a long term deal with a brand).

This sale is a big deal, and the market seems to not be paying any attention to it. As I mentioned in the intro - some REITs are trading at ~9-10 cap rates, while we have a major take private here happening sub 7%! That is just an enormous gap, especially considering the lack of major headwinds facing the industry overall.

Fin

So hotels are cheap in the public markets, I believe on both an absolute and relative basis compared to other CRE asset classes. And things look even better when factoring in the relative growth profile of many hotels going forward as business & group travel continues to recover. Leisure faces some headwinds but most REITs should be in a good position to grow NOI over the next few years.

The industry has already seen one take private and I would wager more will come if REIT prices stay where they are today (and the treasury market calms down a bit!). You have wide public/private discounts, growing cash flow, and high enough yields to actually carry buyout debt loads.

Hotels are also cheap on an absolute basis relative to replacement cost. Replacement cost is a concept that gets far too little attention in public markets (which is to say just about zero), and debatably too much, or at least the wrong kind of attention in private markets (as anyone knows who has seen an OM from a broker touting a shitty suburban office deal in a no growth market as being ‘well below replacement cost!’).

It doesn’t make much sense to discuss replacement cost at a sector level as there is far too much variation between hotel types and geographies, but I’ll dive more into this subject in my next article where I will do a deep dive into a single hotel company I think is interesting.

This is on average - a single tenant office on a long term lease will of course have a much lower capex burden.

I should also point out that multifamily REIT cap rates are as of today a good deal higher than private market values, given the recent selloff in multi REITs. The multi space is also starting to get interesting, but that is a subject for another time.

Obviously this scale matters when thinking about potential cash flow a given REIT can generate, & all else equal a larger REIT should trade at a slight premium to a smaller one. Also worth noting many hotels present some kind of hotel level ebitda that usually excludes G&A.

Full service would be a Hilton, Marriott, Hyatt etc with food service and event space. Limited service would be a Holiday Inn Express. Select service would be like a Hilton Garden Inn - basically in between full and limited with some limited food service/meeting space.

In particular things like a common area refresh can get fuzzy. What is the ROI on a nicer lobby or bar? It’s definitely not zero, but can be hard to calculate. Further there can be a bit of a treadmill effect if enough owners are renovating or there is sufficient new supply, whereby the investment becomes more about preventing a decline as opposed to growing income. So there is still a return, but one could argue that as it is needed to maintain rather than grow noi this is more ‘maintenance’. The way I think about this is something simple like refreshing 20 year old bathrooms really is more maintenance, but something larger like a complete upgrade of the common space, if it really does allow the hotel to compete in a new way, is often accretive or at least partially so. This is relatively easily analyzed at the level of a single asset, but given the lack of disclosures is much harder to do at a REIT portfolio level.

This is based on REIT historical figures, Host in particular as Host is the largest hotel REIT by a long shot.

I think frankly lower class multifamily faces many of the same issues but this capex burden has been swept under the rug by the flood of value add buyers capitalizing everything into an up front rehab.

Again remember this is going to vary based on portfolio and quality - a really high value portfolio is going to have a relatively lower capex burden due to the relatively higher value of land vs physical plant. As REITs typically have high quality portfolios their capex burden is going to be lower than an owner of lower land value assets.

In the private markets - again the public multi REITs have seen a big selloff recently and range from ~6-7%.

This is way oversimplified - setting aside Covid, which hopefully is a once every ~100 year event, in the GFC many hotels saw a ~50% decline in earnings, but a slow bounce back. Milder recessions obviously are less bad. So 10% is a decent rough estimate - it’s a bit worse than that in bad recessions, and less so in mild ones. If you assume every other downturn is a bad one you get to roughly 10%.

Again this is based on current multi cap rates of mid to low 5s. We might be seeing another leg up in multi cap rates as I write this due to a further rise in rates & some softening of fundamentals - if this does play out these numbers would need to be increased another ~25-35 bps probably, but the same general concept remains true.

Most notably conventions & conferences.

Hilton does share these figures in Q1 but it appears to be global. Interestingly it is basically the same globally, but leisure is a point higher and group a point lower. As far as I can tell from US REIT results the US mix is still lagging behind significantly relative to the rest of the world.

I believe this is on an occupancy basis, as disclosed elsewhere total revenues are in fact already higher driven by higher rates.

There is some anecdotal evidence of this but I haven’t seen any comprehensive data on the subject.

Except perhaps ultra luxury as I noted above… the current rates don’t seem sustainable to me.

Very good article. There is a lot of nuance to PIPs, PIP timing and how to pay for it. Speaking generally about branded select service hotels, owners will have a softgoods PIP every 5-8 years and a softgoods + casegoods (furniture) + common area reno every 10-16 years. Using the HVS/Nehmer Hotel Cost Estimating Guide (https://www.nehmer.com/costguide/) as reference, the per key cost for the 10-16 year PIP is substantially higher than a softgoods PIP. To fully reserve for PIP cycles out of cash flow requires reserving much more than 15% of EBITDA.

What's more, brands dictate when owners make PIP investments...irrespective of ROI on that investment. Where a multifamily owner can time a reno to capture a healthy delta between in place and market rents. The brand will expect you to PIP a property when it's due per the franchise agreement even if you're #1 in the comp set.

I love hotels. The operating leverage is thing of beauty. It costs the same to make ready a Hampton Inn room whether guest paid $75 or $300. Owning a high demand location where new supply is constrained or extremely expensive (per your comments re replacement cost) from a real estate perspective is second only to having your finger on CTRL+P at the Federal Reserve.