A swing and a miss

University of California's poor BREIT investment

Introduction

Hello all - I have been considering writing the occasional essay on the commercial real estate (CRE) markets and the UC endowment’s recent investment in BREIT inspired me to finally get off my ass and do so. I am a commercial real estate investor and run a firm called Warden Capital. Unlike most in the space, I invest in both the private and public markets. The public real estate markets are really interesting right now, but many institutional investors are so siloed and/or in love with private market opacity that I believe they are missing out on some great opportunities on the public side.

The intent with this Substack would be to write about interesting CRE investments (both good and bad), & market developments that catch my eye and I want to dig in on further. My hope by writing these articles is two fold. First I hope it helps hone my own investment process by forcing me to put some work up to public scrutiny. The second is that I meet some interesting people in the CRE universe through putting my thoughts out there. So if you are interested in learning more about myself or Warden Capital, or just completely disagree with something, please drop me a line!

I will try to make this as accessible as possible, but posts will assume a certain level of investment knowledge of the reader base.

Also a disclaimer: nothing here should be construed as investing advice. Please see full disclaimer here. Do your own research, and consult with a financial professional.

The deal

For those who missed it, the University of California system endowment recently made a $4 billion investment in Blackstone’s non traded REIT, called BREIT. Much of the press has been pretty positive and seems to think UC got a good deal on their investment & so I wanted to set the record straight with a different perspective.

As a quick aside - a non traded REIT in like a public REIT, except its shares do not trade publicly but are instead valued by its management team. The management team is typically part of an outside financial sponsor - in this case Blackstone. Management can’t just pull numbers out of thin air, but they have a lot of discretion on where they estimate share values to be, something referred to as Net Asset Value or NAV.

In fairness to BREIT, this is true across private asset classes as well and is perhaps even worse elsewhere (looking at you VC funds).

Some basics of the deal for those who haven’t read it (press release here ) - UC is investing $4 billion in BREIT at Blackstone’s current NAV. UC is also committing to what is a effective 6 year lockup of their investment. To sweeten the pot, Blackstone is putting up $1 billion in shares of BREIT as collateral, guaranteeing an 11.25% preferred return for UC. If you value BREIT’s stock at par, UC is buying it at an effective 25% discount to NAV, up to an 11.25% return. Sounds pretty sweet right? Wrong.

A false discount

To be blunt - UC’s investment is a poor one on several levels. While UC is effectively buying into BREIT at an implied discount - about a ~10% unlevered decline in prices, or a ~20% discount to NAV given BREIT’s approximately 51% leverage, it is not large enough.1 The problem is that the broader private commercial markets are likely down significantly more than this - using Green Street’s property price index levels weighted to BREIT’s holdings (55% rental housing, 23% industrial, 7% net lease, balance a smattering of everything else), I get a rough decline of about ~17% on an unlevered basis. This translates into a ~34.6% decline in NAV at BREIT’s leverage levels.

In other words - UC appears to be buying an asset for ~80 cents on the dollar that would trade for under ~70 cents in a liquidation today. Even if you spot Blackstone some conservative initial marks and use a 15% price decline this translates into an over $500mm loss on day 1 based on UCs $4 billion investment even accounting for BS’s $1 billion in collateral.2 Not sounding so hot any more, is it?

But wait, it gets worse, much worse. That is because investing is not just about any given deal, but also its opportunity cost.

One could argue in complete fairness that the CRE transaction markets are frozen right now, and there isn’t a realistic way for UC to acquire $8 billion of assets (its $4 billion levered 2x) at current prices (the aforementioned 70 cents), and that UC will still have a decent outcome on this investment over the long run buying at 80 cents which is the best it can do.

Setting aside that this premise is debatable - this completely ignores the fact that UC does have an alternative way to invest in CRE at scale.

The alternative

That alternative is the public REIT market. This is where things start to look really bad for UC, because public REITs aren’t just trading at the Green Street estimated ~17% decline in unlevered prices. They are actually trading at a huge discount even to estimated private market prices.

Taking multifamily as an example (approximately half of BREIT’s assets) - many apartment REITs are trading at prices that would imply an unlevered 30%+ price decline from peak values (~6% cap rates vs low 4 cap rates at peak). At Blackstone’s leverage levels, this would be equivalent to a mere ~20 cents on the dollar vs the ~80 cents UC is paying. This isn’t entirely a fair comparison, as most multi REITs have low leverage levels, and therefore there is no ~20 cent asset actually available for purchase (at least at scale, some smaller multi REITs are more levered)3. But the general point should be clear - UC is leaving a huge amount of money on the table with this deal.

How much exactly? The table below compares UC’s returns buying into a multi REIT vs BREIT today, assuming private multifamily generates an ~8% annualized return for the next 6 years. I used Camden Property Trust as a rough proxy here to calculate my public returns, as its apartment portfolio is skewed to the Sunbelt like BREITs. The returns understate the true difference here again as BREIT is significantly more levered than Camden, which is only ~20% levered compared to BREIT’s 51% - so the BREIT investment has much more risk in a downside scenario on top of its lower returns.

If private markets only generate a 4% annualized return over the next 6 years (for example if prices fall further before recovering!), BREIT’s greater leverage really starts to drag down returns.

Why REITS and BREIT are comparable

Commercial real estate is, in general, a commodity. Many developers would like to believe otherwise, that their project in special, but good investors know this is not really true. CRE’s returns vary significantly across asset classes (apartments vs industrial vs retail), and between markets (say Austin vs Cleveland), but within similar markets & asset classes, assets are ultimately quite interchangeable. One apartment complex in Dallas is going to behave in a very similar manner to another comparable project in the same city. There are quality differences for sure, but in general REITs own B and A assets, and one REIT portfolio is going behave broadly similarly to another so long as they have similar characteristics (these characteristics vary by assets class by age and market are important across the board). As an aside, retail and hospitality are the least commoditized asset classes, something perhaps worth diving into in a separate article (think an on the mountain ski resort vs a roadside hotel or a top tier mall vs, well, a dead mall).

Critically, the larger in scale one goes the more true this commoditization is. At a smaller scale, one could argue that BREIT for some idiosyncratic reason or another weathered the broader market price declines. Perhaps Blackstone got a good deal on its purchases, or it was in markets that were performing better. Unfortunately, at $142 billion in assets, Blackstone is simply too large for this to be the case. BREIT is larger than nearly the entire publicly traded apartment sector combined. BREIT owns across across all the major markets, with a concentration in the growth sunbelt markets.

So - I’m pretty confident that at the current size, BREIT’s returns are going to be pretty close to the broader CRE market, at least after adjusting for asset classes and markets they are invested in. Maybe BREIT outperforms by a bit, but this weighed by its high fee load - they charge a high 1.25% of NAV as an annual management fee plus a incentive fee of 12.5% over a 5% hurdle rate. Prologis, which is of a similar size, has a G&A load of about .33% of equity (equity basically = NAV here, NAV is just per share) with no incentive fee.

This isn’t even to mention the front loaded fees many smaller investors face when buying into non traded REITs, but that is a subject for another article!

BREIT portfolio details

Here is what BREIT owns, straight from the horse’s mouth (BREIT’s fact sheet).

The only real reason I could see BREIT’s NAV holding up better than the market is if their marks were conservative going in to Q1 of 2022. Its worth noting that Blackstone has exactly zero incentive to do this, since Blackstone gets paid an incentive fee based on their own self evaluated performance. As far as I can tell however, BREIT doesn’t appear to be undervaluing their assets.

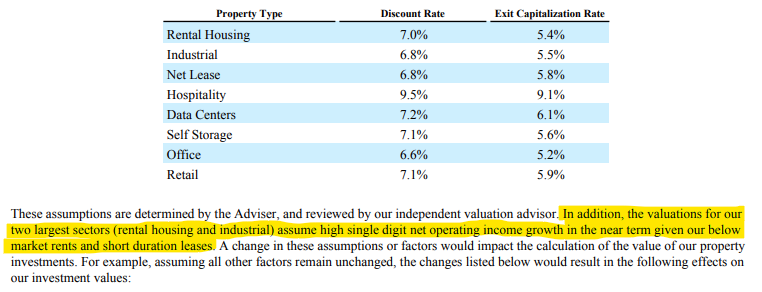

Again using multi as an example given its ~1/2 of BREIT’s value, as far as I can tell, it looks like BREIT is currently marking its multi assets around a ~4.1% cap rate. This is based on reverse engineering their valuation assumptions, which utilize a DCF (I assume 10 year, not specified that I could see), a 5.4% exit cap rate, and a 7% discount rate (for multi, they are slightly different for each asset class). These assumptions all sound so reasonable, no? A 5.4% cap rate, how conservative one might say! But if you dig in it is not so. Given we are working with a DCF, the most critical assumption is what NOI growth rate assumption Blackstone uses per year, in addition to the discount rate. If you look in the footnotes, Blackstone notes that they are using ‘high single digit’ NOI growth numbers in the early part of the forecast period.

Here is the excerpt from BREIT’s prospectus on their valuation DCF inputs

If we use 8% NOI growth in year one, then burn down to 3% in year 4 and leave it there for the remaining years (3% NOI growth is a very common plug number for CRE forecasting), a ~4.1% cap rate today gives us just about a 7% rate of return on the nose given 51% leverage (I used an interest rate of 4.75% if you are curious, it could conceivably be lower but that would imply an even lower cap rate being used in the valuations!). 4.1% is, perhaps not coincidentally, right around or even slightly above the cap rate many multifamily properties were trading at in Q1 2022 and Q4 2021.

That compares to public multi REITs trading at around a 6% cap rate as of this writing - an enormous difference! And just to double check the portfolio is relatively comparable, I went ahead and checked YTD NOI growth from BREIT, which is about 8.5%, to Camden, which is about 7.3%. A little better for BREIT, but not enough to span the yawning 190 basis point cap rate gap, and the difference may well be accounted for by differing same store pool treatments.

In fairness to UC I’ll round out the rest of BREIT’s portfolio relative to public markets. First to note - BREIT’s rental housing portfolio includes a large amount of single family rentals or SFR. However the SFR REITs are trading at similar 6+% cap rates as the multi REITs, so the above analysis holds here. Public industrial is trading around the mid 4 cap rates publicly, which is probably in line with UC’s investment basis. Public Net lease is trading actually at a premium to private market values - public is ~6% vs private probably closer to 7%. This sector’s values can be more idiosyncratic though depending on asset type/ quality and what the contractual rental escalations are. A big chunk of BREIT’s value in net lease (maybe half) appears to be a sale lease back of the Bellagio back in 2019 at a rumored 5.75% cap. Its hard to imagine private cap rates today for that deal would not be much higher given how much higher interest rates are - so I would guess these assets trade today well below BREIT’s basis. Another L for UC. Finally rounding it out - storage, office, hospitality and retail are all trading at pretty hefty public discounts, which are in turn again based on large private market markdowns. So for all of these UC would be better off by a long shot buying the REITs. So putting it all together, for ~22% of BREIT’s portfolio (the industrial portion) UC probably paid a reasonable price, but for the other 78% UC paid way above what it could get in the public markets.

Blackstone’s point of view

So the deal is bad for UC. What about Blackstone? Presumably they know where the marks on BREIT really ought to be, and so they are getting a $4 billion investment at ~80 cents on the dollar, when the true value is something more like ~70 cents. This is a decent deal by itself, but doesn’t account for the $1 billion in shares Blackstone is pledging to the JV. Of course if NAV really is impaired, these shares aren’t actually worth $ 1 billion. Per our math above, they would really be worth more like ~$694 million. And based on a 6 year hold period, if BREIT is able to hold their marks relatively constant, the $4 billion will generate ~$300mm in asset management fees, leaving Blackstone’s true exposure at more like $400mm.

However this is still $400mm of value they don’t have to give away - so why do it? My guess is that Blackstone believes (correctly) that most retail investors, which is the primary investor base in BREIT, won’t understand the structuring involved here and won’t realize shares are being sold at a discount. So it signals confidence in the NAV, and presumably Blackstone believes this may prevent some amount of withdrawals from BREIT.

Furthermore it provides liquidity to pay out BREIT’s owed redemptions, and allows Blackstone to avoid selling assets into the current market. If BREIT sells a multi project at a 5 cap (or worse) they are going to have a much harder time justifying their current valuation marks, and would likely have to begin marking down their NAV. My best guess is Blackstone desperately wants to keep BREIT’s NAV flat and to just wait out the decline in prices if at all possible.

I don’t know what Blackstone internally values their fee income at, but I know that some of the other large managers were internally valuing this income around 20-25x pre-interest rate spike. The profit flow through on fee income at this scale is usually around 50%, and its probably even higher at the margin. If we assume Blackstone values their fee income at a 15x multiple (marked down for interest rates), then we know Blackstone thinks they would breakeven at about $26.66mm in fee profits, or about $53.3mm in fees / year. This much fee revenue would be generated by about $4.26 billion in equity.

So if Blackstone prevents ~ $4.26 billion in withdrawals (about 6.26% of NAV, vs their quarterly redemption limit of ~5%), or this allows them to generate more inflow in the future, this deal is probably a win for them. If BREIT is able to ride out this downturn with a fairly steady NAV, it should probably allow them to raise even more money in the next up cycle. Talk about volatility laundering! (h/t to Cliff Asness for trying to popularize this term)

Miscellaneous thoughts

A few other errata I wanted to mention. The first is that I was struck by how awful BREIT’s dividend coverage ratio was. I figured going into this article the ratio wouldn’t be great (hard to buy assets at low 4 caps and pay a 4+% dividend), but I was frankly shocked at how poor it was. Here is their latest funds from operations (FFO) / adjusted FFO (AFFO), and funds available for distribution (FAD) calculations.

Yes, I am terrible at highlighting - coloring booking were not my strong suit as a child.

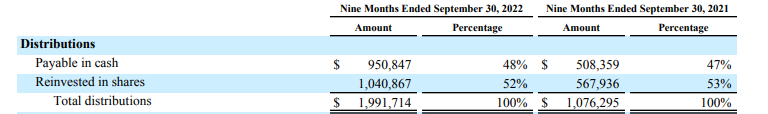

It is worth noting there is no exact standard way to calculate these numbers, however excluding recurring tenant improvements, leasing commissions & capex from AFFO, as BREIT does here, does not make much sense, and most other REITs do include this in their AFFO calculations. Also the exclusion of the management fee from FAD is pretty misleading - this is similar to tech companies reporting positive ‘adjusted ebitda’ while excluding stock based compensation (the mgmt fee is paid in BREIT shares). Adding the mgmt fee back in to the 9 month YTD FFO bring us to $870mm in FAD year to date. However, Blackstone paid out $1.991 billion in dividends in the same period!

How can this be? The key trick is Blackstone is paying almost all of its management expenses in the form of shares to itself, freeing up cash for the dividend. It also appears that the $1b ‘reinvested in shares’ is just issuance of new shares - this isn’t entirely clear from the cash flow statement, but the paid distributions there is only $925mm, fairly close to the $950mm here.

Even so - you’ll note that adjusted FAD is still less than their cash dividend, and so they must be using cash on hand to pay out even the cash portion of the dividend, which is itself less than half of the true expense. The ratio has gotten worse recently and will likely continue to deteriorate as higher interest rates and declining operating fundamentals filter through the portfolio. For comparison almost all of the public REITs have very strongly positive FAD or AFFO to dividend coverage ratios, as opposed to BREIT’s deeply negative ratio.

This isn’t necessarily relevant to UC’s investment - they bought in at a discount, and they are probably betting more on capital appreciation than cash flow. But it just illustrates the precarious position BREIT is in & I thought any retail BREIT investors might be interested.

Also - it is hopefully glaringly obvious that I make no comments on the future direction of the real estate markets. I have plenty of opinions in this area, however for purposes of this article it doesn’t really matter so I’ve left them out. Regardless of where you think prices and income are going, the analysis above holds true. UC is simply buying something here for more expensive than they could get elsewhere - its analogous to buying a bond or stock for above market pricing. Don’t worry, I plan on sharing my views on the CRE markets in future articles.

Closing

If you found this interesting, please subscribe and I’ll try to write articles semi regularly as my investing and asset management schedule allows. More importantly - would love to hear from you if you are an investor or operator in the CRE space.

BREIT lists leverage as 47% on their fact sheet, but if you actually calculate the numbers from their most recent prospectus I get more like 51% based on gross asset and debt values - BS excludes pro-rata debt on non controlling interests from their leverage calcs, but appear to include it in their asset totals, thus reducing stated leverage a bit. Also worth noting BS excludes effective senior leverage on their financial investments of about $15.6 billion - as far as I can tell if you included this it would push leverage up to just over 55%.

Its important to remember that BS did not contribute cash to the JV, but shares valued at par. So if true NAV is lower, the collateral for UC’s investment is also lower.

As a quick reminder, leverage amplifies price movements both up and down. So because BREIT is more levered than the public REITS, the same unlevered price decline will yield a much greater equity price decline in BREIT than the public REITs. It should go without saying that the increased leverage comes with greater risk as well, especially in today’s higher interest rate environment.

Ah guess I could have made that more clear. By par I just mean the current stated NAV for BREIT - that's the 100 cents on the dollar in my analysis here. So the 25% discount is imputed from UC's $4 billion investment at current stated NAV less the $1b in face value collateral Blackstone posted (3 / 4 billion). However because if there is an actual impairment to NAV then the collateral itself is also impaired, and therefore is worth less. So the implied discount is more like 20% to NAV.

Insofar as the quote below - I just meant that the collateral only applies in scenarios that include a loss up to an 11.25% annualized return - above that it goes away. So UC's upside isn't the same as if they actually just bought in at a flat price discount, the discount only applies in the scenarios from loss to 11.25% return. That lack of upside itself has some value too so you could argue this would further reduce UC's implied discount, but I figured that was getting too far into the weeds.

Great piece. Looking forward to reading more stuff from you.