Welcome to our Q3 update, where I will discuss the CRE markets and the US economy at a high level. I will dive into CRE asset class specifics in part two. My delay in publishing the Q2 part 2 made me realize I should have been waiting to put out part 2 all along & I intend to stick to this structure moving forward. As many of you are likely aware corporate quarterly reporting is well delayed from the actual end of quarter, and by waiting I can incorporate all the actual Q3 results into my work which is nice & much more timely than discussing the prior quarter.

Please see here for our general disclaimer. Remember nothing in here is investment advice!

First, as always, performance. This quarter was an excellent one for the REIT market, and we also benefitted from that. However due to macro uncertainty (more on that later) I have moved into a very defensive cash heavy position, & so we missed out on some of the gains.

We returned 9.08% YTD, vs 16.05% for the USRT REIT index & 21.66% for the S&P. Since inception we are still outperforming by a large margin, at 189.58% for the fund, compared to 75.68% for USRT and 113.92% for the S&P.

The fund’s performance is a ~27% annualized IRR since inception.

Our underperformance this year is driven by hospitality really underperforming the broader REIT index, a few small caps that don’t move in line with the broader market (but I think long term are attractive), and also my relatively large defensive cash position, so we have missed some of the recent rally.

My concerns over the US macro situation continued to grow since my last letter, leading me to take said large cash position. Many indicators for the US economy are/were flashing orange or even red. Unemployment was steadily rising, and we briefly breached the threshold of the Sahm rule, which basically says that (historically) once unemployment is up over 50 bps we are heading into a recession.

However - the most recent set of data was much more positive. In particular the September jobs report was very good, with strong job growth, unemployment falling further (and below the Sahm threshold), and the prior two months being revised upward.

Unemployment rate over time.

My position was and is that we are either in a growth scare, or the early stages of a recession. A few weeks ago based on a barrage of negative data I would have put the near term recession odds fairly high, maybe almost 40%, but with the recent positive data I would push that down a bit, around 30-35%. 1 month is noise, but by 3 months it starts to feel like a trend. With 2 positive months in a row we are heading in the right direction, & I think we will know one way or the other by December or so whether this was indeed just a temporary slowdown or the start of something larger.

On the negative side, a number of consumer oriented indicators have begun to look rough in the last few months, a few charts below.

Consumer confidence is down

The present situation sharp decline is particularly concerning here

Restaurant spending is down

This data series is not as old as some others but it is an interesting view on consumer spending

and auto loan delinquencies are up sharply.

Chart is from the FT & ultimately S&P / UBS

Now - an important consideration here, which is why my confidence levels are relatively low that we are going to be in a recession (unlike the doomers you see all over the media), is that many of these indicators have been triggered to some degree (or close to it) by growth scares. Unfortunately many of the newer data sources don’t go back all that far, but the ones which do (manufacturing & unemployment), consistently show weakness during growth scares as well.

Specifically if we just look at the sample set of prior growth scares, we can see that extended weakness in manufacturing and unemployment has predicated a recession ~80% of the time (eg 2/10 were false alarms or just growth scares). Those are not great odds!

But what muddies the water here is the unique covid driven, supply side dynamics of the last recession & the recent recovery. Combine this with the relatively smaller importance of manufacturing to the US economy today and the small sample size of recessions in general, and even smaller of supply led recessions, and I believe it is very hard to generalize from the prior data to today. All I can say for certain is the fog of war is thick.

Stepping back, if you think of the US economy as having a few major drivers, we clearly have two - the consumer & manufacturing, that are softening or are outright soft. On the more positive side though, tech, which is arguably the major underlying long term driver of us economic outperformance, is clearly coming out of its downturn from the last two years, and AI/ML has made dramatic progress in a very short period of time. This new technology is likely already driving productivity improvements in the large professional services sector1, helping counteract weakness elsewhere and laying the groundwork for long term growth.

Inflation

This letter would not be complete without some inflation commentary, given its prominence over the last few years. The biggest news in inflation is that it isn’t really ‘news’ as much as it used to be, which is a good thing! We have had several very good PCE and PCI readings, which gave the Fed comfort to begin cutting (especially combined with some softening in the labor market).

PCE, the fed’s favored metric, has been looking good across the board. Overall 12 month PCE was down to 2.2% in August, with core higher at 2.7% due to elevated housing inflation. Given housing inflation is in large part supply constraint driven (not to mention highly lagged in the government inflation data), it needs to be viewed as a bit of a separate animal.2

The latest September PCI data came in a bit higher than expected - while overall was only 2.4% YoY and 2.2% MoM, the core and super core data was higher, as we saw the first goods inflation in quite some time (this has been in deflation for a very long time).

You don’t see a lot of signs of re-heating elsewhere in the economy so I’m inclined to view the September increase as monthly noise, but we will see what the next few months of data hold.

Overall I’m relatively sanguine about inflation, and am more concerned with the opposite currently (a downturn). And as I have said time and time again, over the long run it really doesn’t matter all that much given current CRE pricing is below replacement cost. If inflation reaccelerates that means income growth will be high - if it doesn’t then we will likely see cap rate compression instead. Again where this matters is assets with weak demand profiles, like suburban offices.3 Those are going to perform much better in a low inflation environment as it increases the NPV of the leased cash flows, and so your poor residual matters less. If inflation re-accelerates low quality office is not somewhere I would like to be (this asset class is also weak during a recession), and it is not a real holding of ours despite some REITs trading well below NAV, as I believe the downside risks are not worth the upside.

In Sum

Stepping back & taking it all together, at a minimum we face a relatively higher level of uncertainty. Combine this with fairly high valuations in the stock market in general, and it makes for a risk/reward ratio that feels mediocre.

CRE Markets

That said, the CRE markets broadly are looking the healthiest they have been in awhile due to the falling 10 year (although this has ticked up recently quite a lot!) and recent interest rate cuts providing some much needed capital markets respite.

REIT prices have generally rallied almost to NAVs, and if we don’t have a recession I would fully expect private market prices (and REITs) to march higher from here given the significant private declines we have seen over the past 2 years.

The beauty of making public real estate investments alongside private is that REIT pricing is essentially a much more exaggerated version of the above chart. If you can stomach the volatility it means you can buy in at the bottom at prices below the private market bottom, as we did in this recent cycle, and then sell at prices above private at the peak (as we hope to do! Assuming REITs eventually trade at a NAV premium which I think is likely, human nature being what it is). The key thing though is to keep your eyes on the ultimate driver of pricing, the private markets.

It feels very much like CRE GPs are chomping at the bit to begin to deploy capital en masse, and if lenders and LPs begin to become more aggressive I think we should see a strong price appreciation cycle (you could argue it has already started).

However, if we do have a recession it is hard for me to imagine that this won’t negatively impact the CRE markets. Yes falling interest rates would provide debt & cap rate relief, but current cap rates are already predicated on lower rates, eg that is already priced in. A negative surprise on the operations front I think would not be good for the markets (but I could be wrong here! Maybe falling rates offset NOI declines).

The good news is that I don’t think things should be too bad for CRE given the pain we have already been through. A recession by my guess would only lead to a modest additional decline in private prices (or perhaps even just an extended flatline). I suspect REIT prices would react more violently though.

Where I would be really worried was holding the broader market at all time highs and pretty healthy valuation multiples. So I feel pretty good in CRE outperformance moving forward, and especially if we have a downturn.

In particular I am comforted by the ratio of prices for class A assets to replacement cost. With the replacement cost spike since 2019, and prices for many asset classes being lower, long term, prices will have to rise to justify new development in higher growth market. Whether that is via falling cap rates, rising incomes, or both, I am not sure but I am confident one way or another it will occur.

CRE Distress

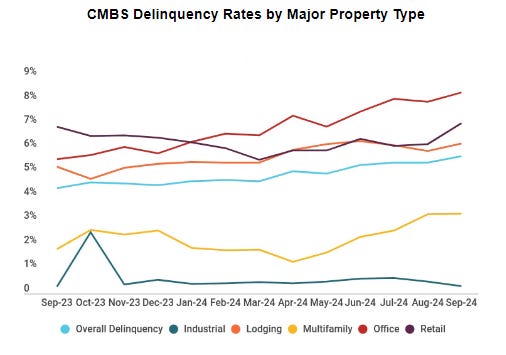

While the outlook has brightened CRE has been through a tough couple of years and given the lagged nature of the system delinquency rates continue to march higher, led by particular weakness in office. CMBS, as per usual, has higher delinquency rates than bank loans, and you can see broader softness in the CMBS rates, below.

Trepp CMBS delinquency rates

Bank loan delinquencies have held up a bit better, with the notable exception of office which continues to climb even despite bank’s typically more conservative underwriting standards.

Trepp bank delinquency data

I fully expect there to be more pain & defaults, especially in office, but there is light at the end of the tunnel. With the rate cutting cycle beginning, levels of distress should peak and begin to decline, probably in the next 12 months (again barring a recession). Maybe office takes a bit longer - delinquencies didn’t peak until 2012 or so after the GFC for context.

I continue to follow some of the public mortgage REITs, several of which are popular short ideas for certain investors. Frankly not that much has happened here and I continue to believe that given price decline levels these firms are right on the edge between taking very little in the way of losses, and potentially significant losses, with high variability between firms based on loan quality. I certainly would not want to own these given downside risks, but think the short value proposition is fairly muddied as if we have a proper soft landing losses might be quite muted thanks to some extend and pretend. We will see what their Q3 results bring.

Lending Markets

Given the ongoing market distress, lending levels remain relatively muted. Quarter over quarter per the latest Fed data, lending was up ~.5%, or 2% annualized. This is down significantly from the boom time 6-8% annualized growth we saw in 2022, but is still positive. I would wager with rates falling and lenders continuing to work through their distressed loans that this growth should accelerate over the next year.

Looking at the fed data at a granular level we see that life cos are leading the pack with ~1.7% loan growth QoQ. It seems life companies are taking advantage of high rates to deploy capital and lock in solid yields. Banks are in the middle at around ~.5%, or just about average. There are still banks on the sidelines in the CRE market, so there is definitely room for bank lending to tick up once these lenders are able to fix up their portfolios and re-enter the market.

Interestingly while CMBS issuance has been very strong this year, but it is mostly refinancing so overall levels outstanding remain flatish. So the ‘wall of maturities’ many have been talking about has thus far not caused significant issues.4

REITs at NAV

Coming back to the REIT market as a whole - things are a lot healthier here, and you are starting to see pent up transactions coming through, with a few IPOs happening, acquisitions picking up and also a number of equity/share issuances. In other words we are pretty close to a ‘normal’ market.

The one place that really has not benefited from this recent rally has been the hospitality market. I will dive into this in more detail in the sector deep dive sin part two, but this sector has the biggest NAV discount right now by a healthy margin. I do not pretend to know why this is, but I would guess softening consumer spending is spooking investors here. The strange thing is that if we really do have a recession other asset classes are going to suffer as well, yet only hotels seem to be pricing one in. This asymmetry creates an interesting opportunity.

On the flip side of this is the senior housing sector, which is trading at a huge premium on recent strong NOI growth and expectations of continued growth. I unfortunately missed out on this rally - the supply / demand set up is admittedly excellent but they were already trading at a premium, and I didn’t appreciate just how strongly NOI was going to grow. Welltower in particular has reached an extremely high NAV premium of over 100%! I don’t have great historical data but this surely must be one of the highest NAV premiums of all time in the REIT space. I do believe in continued income growth here but these pricing levels feel unsustainable to me - supply will almost certainly tick up again before that gap can be closed.

Fin

That covers it for part 1, I will be back in a month or so with part 2 covering the CRE asset classes (which I much prefer). Thanks for pushing through all the macro discussion here - I honestly do not love doing it but it seems like this kind of content is popular given how widespread it is in the financial world.

My own view on macro has evolved quite a bit - for a long time I simply ignored it, and was frankly a bit blindsided by the impact of rising inflation. Looking back at the data I came to the conclusion that high inflation levels were very much telegraphed, and so I began to follow that data much more closely. I feel reasonably good about inflation type macro data (and my forecasts have been fairly accurate since I started making them). I think the overall economy is harder to predict though, given the complexity of that system.

I have been struck however by the typically very low quality of most macro commentary I see, even from well known & supposedly high quality groups. There is a lot of noise, and what is interesting is that most commentators have a lens through which they view pretty much everything (the perma bull, the perma bear, the gold bug, the debt guy, etc). It really is almost like a religion with different sects & holy texts, and it melts my brain a little bit to try and sort through it.

My focus on macro has been a bit of a personal experiment. I still think long term most returns are driven by identifying superior investments, but it seems like there is a bit of additional juice that can be squeezed by monitoring the big picture. Most investors still seem to over index on macro though - in my view it is maybe 20-25% important5, with the vast majority being stock picking & investment sizing, while it feels like, at least in terms of air time, the ratio is flipped and macro gets 75% of the attention from most people.6

Ultimately I’ve got to use something to determine what kind of cash levels to hold, so I have settled on a combination of macro temperature and the opportunity set in front of me.

I’ll be back with the CRE sector specific notes after q3 earnings seasons has wrapped up.

Already you can see examples of massive productivity enhancements, like Klarna replacing much of its customer service force with AI. I recently invested in an AI startup called Hercules which is automating certain legal & finance workflows & driving large productivity gains for the firms using it. The ability of LLMs to ingest unstructured data from documents - contracts, invoices etc, opens up a huge new swath of work to being replaced or massively sped up by software.

I have covered this before but as a quick refresher - actual rental growth is basically zero (and is negative in many markets, and of course mildly positive in a few others), and this is really what ought to be most important when looking at housing inflation. The government data does not reflect this and at this point it is a bit unclear as to what is driving the disparity, but the private data is extremely robust and I am fully confident in its accuracy.

Home prices are up but homes are also an asset so their increase is somewhat neutral societally - it is a negative for first time homebuyers but positive to neutral for current owners. Whereas rent growth is a pure consumer cost and is thus a cleaner read through.

Also obviously it matters if financial change happens really quickly, causing cap rates to spike more quickly than incomes can rise, which of course is the scenario we just lived through. The equation will eventually balance, but the income side of the ledger moves much more slowly than the cap rate side. Going forward though it seems highly unlikely we could have another such spike, as that would require inflation spiking up above even where it was previously, and I have seen zero evidence supporting such a scenario.

People were talking about the same thing back in the early 2010s, and it mostly came to nothing.

I used to be almost at zero percent - I think that is incorrect now but I am loath to make it too high a percentage here. Confidence intervals on predictions are simply too wide to let it be that large of an influence on investing behavior.

And don’t even get me started on macro funds.